Employees

Our employees are critical to fulfilling our commitment to our clients. Through their skills, experience and hard work we are able to deliver on our customer value proposition.

Performance summary

| Indicator | Change | 2017 | 2016* | 2015* |

|---|---|---|---|---|

| Total number of salaried employees | 17% |

3 554 | 4 267 | 4 111 |

| Total payroll (Rbn) | 48%  |

1.5 | 3.0 | 2.6 |

| Employee engagement index | 6.5%  |

54.4 | 60.9 | 63.8 |

| Employee turnover (%) | 2.4%  |

12.9 | 10.5 | 9.6 |

| Average training expenditure per employee (R) | 3%  |

6 387 | 6 585 | 6 641 |

| Productivity: revenue per employee (Rm) | 23%  |

1.0 | 1.3 | 1.2 |

| * Prior-year numbers have not been restated for discontinued operations. | ||||

Highlights

- New leadership brings new skills and thinking to the group and offers exciting

opportunities for change - Recognised 1 397 colleagues’ achievements through SuperSERVE awards

- Redefined the values of the group to refresh the company culture

Challenges

- Availability of scarce skills resources, particularly in pockets such as actuarial and sales

- Employee engagement score declined as a result of the changes during the year

- Discomfort in shifting employees’ historic mandates and priorities

Our approach

2017 has been a period of significant transition as we have successfully shifted towards operating as a leaner, more focused group that no longer operates in silos, but instead offers a single group customer proposition. As a result, there were a number of changes to senior management to better support this transition and bring in the skills sets necessary to deliver our revised growth strategy. Over the period we continued to keep our employees as a key priority in ensuring their productivity and well-being.

Human resources (HR) operates within the group’s shared services function. The responsibility for implementing HR strategy is a dual accountability between group HR and the business divisions. The central shared services resource manages tasks such as hiring, employee induction and exits, and administration of leave. It is also responsible for group-wide leadership, talent management and development strategies.

The move towards the shared services model has accompanied a shift in priority away from transactions towards broader value-creating activities. For example, we now have a more holistic focus on talent management and skills acquisition, not simply new hires. We believe that this will enhance the business’s overall ability to create value.

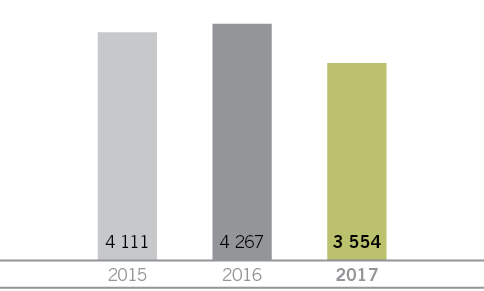

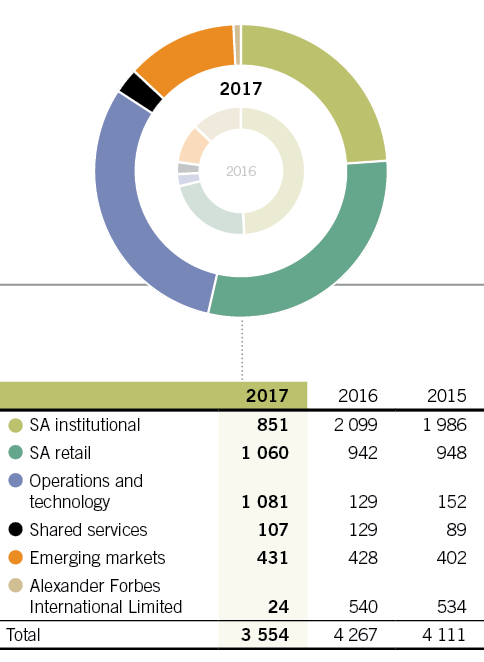

Total number of salaried employees

one business

Total number of salaried employees

Our total headcount decreased in 2017 from 4 267 to 3 554 people. This was in the most part due to the sale of Alexander Forbes Compensation Technologies and our share of Lane Clark & Peacock in the UK. Structural changes saw a significant portion of institutional employees moving into the group-wide operations and technology team.

“ Making a positive difference in the lives of our customers.”

| Key risks | Mitigating actions |

|---|---|

| The risk of key people leaving the organisation, taking key intellectual property (IP) with them or the firm’s inability to recruit and retain top talent |

|

| The risk of cultural misalignment and its effect on morale and, ultimately, performance |

|

Our performance

Creating a compelling employer value proposition

Alexander Forbes’s employee value proposition (EVP) includes offering competitive market remuneration and rewards that contribute towards the financial well-being of our employees now and into the future. We are constantly looking for ways to attract talented employees and work actively to nurture our internal talent pipelines. We believe that by offering competitive benefits and a work environment that encourages collaboration and innovation, as well as by engaging frequently with our employees, we offer a strong EVP. This was reflected in Alexander Forbes being recognised as an Africa Best Employer Brand 2016 at the third Africa Best Employer Brand Awards.

In 2017 salaries across the group increased by approximately 3%. While our employee engagement revealed that there was some sentiment that this increase should have been greater, we performed a benchmarking exercise that indicated that Alexander Forbes is competitive in its total rewards package. On top of basic salary, employees receive benefits as part of their guaranteed pay.

This year, recognising the need to strengthen the group’s incentive structures, particularly at a senior level, we began to design various ‘lock-in’ structures for key people. Towards the end of 2017 we identified critical roles, offering appropriate retention plans.

One measure of EVP is employee turnover, which increased again this year to 12.9% (from 10.5% in 2016), but is still well in line with the industry. Management turnover increased from 9% in 2016 to 13% in 2017 at junior and middle management levels, and from 9% to 12% at senior management. We attribute most management turnover to the period of change and significant restructuring within the group, and we expect that these levels will decrease in the coming year.

This year we introduced an acting allowance policy and enhanced our maternity leave policy, reducing the period of employment after which the policy comes into effect from three years to one year. We also increased the group retirement age from 60 to 62, after benchmarking against the industry.

Remuneration

The Alexander Forbes remuneration philosophy seeks to enable the business to attract, motivate and retain talented high-performing people. Our remuneration policy provides for a mix of fixed (or guaranteed) and variable pay. This mix is aligned with market best practice and consists of the following components:

Guaranteed pay

This is aligned with market levels and provides the individual with appropriate security and reward in terms of salary and market-related benefits, including retirement funding, medical aid, and death, disability and funeral cover. Our guaranteed pay is typically benchmarked against the 50th percentile of the financial services market. This allows exceptional performers to earn up to the 75th percentile in total through short-term incentives, subject to the individual’s performance, the group’s performance and the available funds in the bonus pool.

Short-term incentives (STIs)

Our STI scheme aims to reward performance for meeting short-term organisational targets. Objectives and measures are derived from the overall annual strategic objectives and cascaded through group, divisional and individual scorecards to ensure that everyone is working toward the same overarching objectives. Individual and corporate performance targets, both financial and sustainability-related, are tailored to the needs of the business and reviewed regularly to ensure they remain appropriate.

The quantum of the incentive is subject to the size of the incentive pool (which is dependent on net profit), a policy of incentive capping (Level 1 to 3 employees are generally offered a 13th cheque, while some employees from Level 3 to 5 are eligible to receive up to 200% of their on-target bonus as their incentive), our performance measurement scorecard and bonus deferral for divisional managing directors and any other identified roles.

Long-term incentives (LTIs)

The Alexander Forbes conditional share plan applies to executive directors, senior managers and other key executives and managers of the company. Conditional shares are awarded on a sliding scale at a level that is appropriate relative to guaranteed pay. The incentives are offered over a period of three or more years and are designed to align performance with achieving the group’s long-term objectives; act as a retention mechanism for senior executives; and drive a culture of continuous and sustained growth and improvement within Alexander Forbes. To align shareholders’ and executives’ interests, the vesting of conditional shares is conditional on achieving performance conditions measured over a period appropriate to the strategic objectives of the company.

Employee share ownership includes the forfeitable share plan (FSP) and the Employee Share Ownership Plan (ESOP), each of which is designed to enhance the ownership of the company and to align employee interests with the company while supporting their financial well-being through regular dividends.

The ESOP exists for the benefit of all permanent employees in South Africa who are not part of the executive long-term incentive plan, and there is a significant weighting to qualifying black women employees, who enjoy 70% of the beneficial interest. The ESOP shares represent approximately 2.9% of the issued ordinary capital of the group. In 2017, R4.5 million in ESOP distributions were made to employees.

For more detailed information on our remuneration policy and practices, please see the full governance report at

www.alexanderforbes.co.za/investor-relations/integrated-reports

Maintaining a positive work environment

During 2017 Alexander Forbes welcomed a new chief executive, as well as various other senior executives. Under this guidance the group has restructured and refreshed its strategic ambition. This has involved – at an employee level – changes to historic mandates as well as a move from a direct line of control management to matrix accountability.

These changes are crucial to the success of the group. During this period we are pleased that there have been no significant retrenchments in South Africa arising from the restructuring and business consolidation processes, although some people have been redeployed within the business.

Our values:

1 Collaboration

3 Customer first

2 Integrity

4 Trust

The restructuring has, however, been reflected in the engagement levels of our employees. Our annual employee engagement survey showed our engagement index score declining to 54.4 from 60.9 in 2016. The primary areas of concern were remuneration and benefits, care and concern for employees, and recognition of achievements. We are addressing these by reviewing our rewards and benefits strategy, as well as promoting greater consistency across fairness.

The changes at senior management level have afforded the group with a unique opportunity to bring in new and fresh thinking, including international insight and perspective.

As the group embarks on a new strategic era a key component will be to ensure that the right culture and values are in place to support the strategic execution.

| Culture diagnostic |

|---|

|

In November 2016 we initiated an organisational culture diagnostic. Employees participated in an electronic survey to allow us to uncover insights into the current and desired organisational culture. The diagnostic showed that our current culture is predominantly results-based, while our target culture – agreed upon by most employees – is more purpose-orientated. Going into 2018, we have been taking a bottom-up approach to articulating and reinforcing the group’s desired culture. |

To address employees’ questions and concerns, and to ensure that our employees are included in driving the group’s strategic priorities, the new chief executive embarked on a significant number of roadshows to engage with employees across the group and to describe the group’s revised strategic vision and the need for change within the business. These roadshows have been followed up with regular video messages and leader-led engagement sessions with employees. We also continue to engage with our employees through a variety of events, internal newsletters, publications and communiqués.

Managing for high performance

All employees receive at least two formal performance reviews each year. These are facilitated by the HR department and delivered by line management. In 2017 we continued to improve on the quality of these discussions and on the frameworks and KPIs against which employees are measured. We intend that this will improve the objectivity of the review process and will help us to manage performance more tightly. The outcome of performance reviews is linked directly to employees’ rewards through our short-term incentive scheme. (See the remuneration report for additional detail.)

| SuperSERVE winning team: Autosave App |

|---|

|

Taking aim at the freelance space and burgeoning gig economy, actuarial student Fria Hiemstra, business and procurement specialist Jadie Naicker, maths whizz Amy Harding and marketing maven Katherine Madley developed an idea that addressed a brand new market for financial well-being. The four have created a retirement and emergency savings app aimed specifically at entrepreneurs and the freelance market, and entered their business case into Alexander Forbes’s innovation programme. The team was awarded both a prize and an exploratory budget to further develop the product. |

In our SuperSERVE recognition programme employees are encouraged to nominate colleagues who best embody the group’s values in their daily work. Rewards range from ‘badges’ to public recognition and cash prizes.

During 2017, 1 284 employees were awarded silver SuperSERVE awards, 90 were awarded gold awards and 23 employees were awarded platinum SuperSERVE awards – the highest level – in a formal event held in July 2016. Each of the individual platinum winners received a cash prize of R15 000.

Ensuring continual development

Part of our EVP is offering our employees the opportunity to grow professionally. The courses we offer include the Duke University leadership development programme, Harvard’s manager mentor programme, diversity management training and managing generations.

In 2017 we partnered with Degreed, which is an online learning platform that our employees will use in 2018, for their own training and development, at their own speed. Degreed offers various courses in business administration. The group also awarded 82 bursaries to employees’ children and 403 company bursaries. The company bursaries enable full-time employees to study post-matric and university qualifications that will develop their own proficiency and advance the employees’ careers within the group.

R22.7 million spent on training in 2017

2 819 employees trained

R6 387 spent on training per employee

Furthermore, 60 recent graduates participated in our internship programme (60% black) and 108 participated in our learnership programme (96% black) – a 33% increase from 2016. 25 learners joined the retail team and 83 joined the institutional cluster. Both the internship and learnership programmes are 12 months in duration. The internship programme is aimed at university graduates and the learnership at school leavers (matriculants).

In 2016 the retail clients division launched its retail academy, which aims to enhance employees’ technical skills and personal development. The main focus areas of training within the retail academy are:

- Upskilling staff on product and sales training

- Client service training in the insurance claims and call centres

- Management training

- Induction and development training programme for business development consultants and well-being consultants.

Safeguarding employees’ wellness

We are cognisant that our employees’ work/life balance is important to their overall well-being. Happy employees are productive employees. We support our employees with flexible working hours on a case-by-case basis when the nature of their job allows.

2 002 employees in SA took advantage of the holistic health risk assessments we offer at our headquarters – up from 700 in 2016

565 employees made use of the confidential wellness hotline

31% of our staff are registered for the group’s e-Care online system

Our headquarters in Sandton offers employees gym facilities, a physiotherapist, a spa and a wellness clinic. A series of wellness events during the year grant employees access to voluntary HIV counselling and testing as well as other medical check-ups and information, including glucose and cholesterol tests. All employees participate in medical aid schemes, which provide access to a range of benefits including a disease management programme.

We have partnered with ICAS to offer our employees access to counsellors who can provide advice on legal, marital and other social issues via telephone, e-mail and face-to-face meetings. To provide our parent employees peace of mind, we offer a space-subsidised crèche at our group headquarters, which 27 children of our employees attend.

In 2016 we launched our financial well-being programme to our employees, encouraging them to learn more about protecting and growing their personal wealth; evaluating their own financial habits; and recommending tools and products for investing, saving and risk coverage. We did not hold an employee financial well-being day in 2017, but we plan to do so again in 2018.

Our employees are all trained in the Occupational Health and Safety (OHS) Act during their induction and regularly during the year by group health and safety co-ordinators and OHS team members. During 2017 the group experienced ten work-related injuries and no work-related fatalities. The group applies the OHSAS 18001 management system but has not yet been accredited in this regard.

Building a diverse and inclusive workplace

We are committed to building a diverse workforce that reflects our clients, our investors and the countries we serve. This means bringing together a mix of skills, experience, culture, gender, age and race. It also means taking a focused approach to recruiting, developing, retaining and promoting black talent.

| 2017 | 2016 | 2015 | |

|---|---|---|---|

| % black employees | 71 | 68 | 66 |

| % women employees | 63 | 58 | 56 |

| % black women employees | 45 | 43 | 42 |

While we are generally pleased with the transformation taking place within our workforce, meeting our targets at middle and senior management levels remains a challenge. See ‘Actively practise transformation’ for further detail of our transformation agenda.

505 new employees in 2017 in South African operations, of whom 89% were black and 50% were black women. 56% of all new recruits were female.

60 internal promotions, 65% of whom were black employees.

This year the board of directors introduced a gender diversity policy aimed to increase representation of women at the most senior management levels. The policy requires that 30% of the board should comprise women within three years.

In 2017 we also ran diversity management workshops for all employees. These comprise an externally facilitated, two-day course and aim to equip employees with skills to tolerate and manage working in a diverse work environment.

Looking ahead

In the coming year we plan to launch our Future Leader Programme (FLP), which aims to create a healthy pipeline of next-generation leaders by developing, fast-tracking and retaining young professionals in the organisation. The programme will comprise three six-month rotations through core Alexander Forbes business areas (both local and within emerging markets), and then a final six-month upskilling and settling rotation in the best-fit area. The programme participants will be limited to those aged between 25 and 33 years, with at least two years’ working experience.

Over the next three years we anticipate that the FLP will provide between 15 and 20 candidates to fill divisional leadership gaps at junior and middle leadership levels – producing leaders with outstanding customer and management skills, deep functional expertise, strategic thinking, innovation, ambition and leadership ability.

In 2018 we will also launch the CEO bursary programme. This will be administered by the Alexander Forbes Community Trust, based on a new invested endowment of R4 million. The proceeds will fund students to study qualifications within the financial services industry at different universities in South Africa. The first students are expected to enrol in January 2018.

A priority for the coming year will be to address the low employee engagement scores. We will focus on providing direct access to the chief executive, through roadshows, videos and correspondence. We will also roll out a change management initiative to help employees to understand, be a part of, and make a meaningful contribution to fulfilling the strategic ambition of the group. We are also improving performance management by changing our philosophy, and the system of – and the manner in which we set – key performance indicators.