Clients

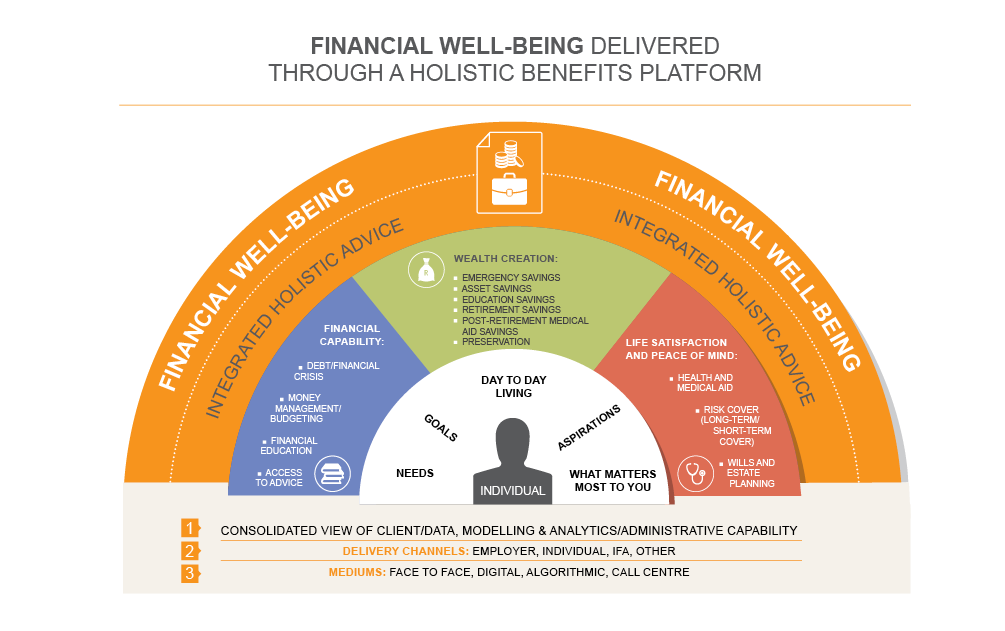

Our clients are the cornerstone of our strategy: they buy our advice-led solutions and provide our revenue. If we add value to our clients, by understanding their unique requirements and aspirations and delivering holistic and integrated solutions, we are able to add value to each of our other key stakeholders.

Highlights

- Innovative InFund Solutions launched

- Client retention remains high – more than 97% of institutional clients and

85% of retail clients stayed with us during 2017 - R9.9 billion in new asset management business

- Emerging markets achieved R1.25 billion assets under management in

Botswana umbrella fund (after the loss of a large client)

Challenges

- Alexander Forbes’s brand is still not strong in the retail market

- Loss of a large client, the Botswana Public Officers Pension Fund, within the

emerging markets business - Low-margin and cyclical nature of public sector business

Our approach

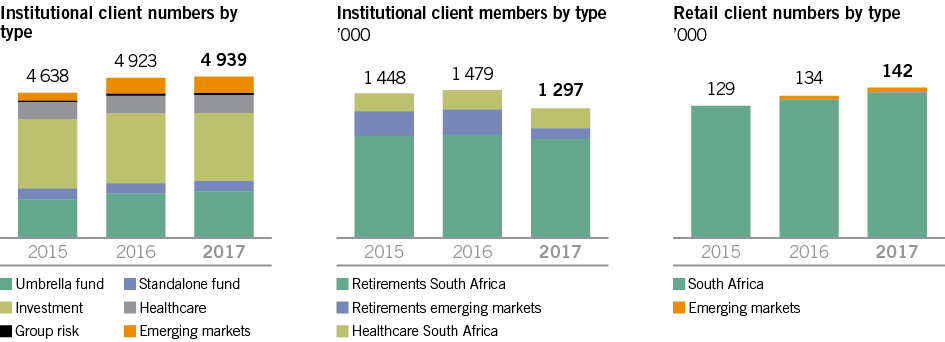

Our clients remain at the centre of our group strategy and Ambition 2022. We have worked hard this year to understand them better, to improve our customer offerings and interfaces, and to centralise our customer touchpoints. Across the group, we have almost 5 000 institutional clients, more than 1.2 million client members, and over 140 000 retail clients.

| Key risks | Mitigating actions |

|---|---|

| The risk of inherent volatility in earnings and its impact on growth |

|

| The risk of inappropriate or unclear value proposition, product set and price points |

|

| The risk of member-level access strategies not being successful |

|

| The risk of delayed innovation in business applications, tools and customer-facing solutions |

|

Our guiding ambition is one of client-centricity across the group and we have made substantial progress this year in creating a client-centric operating environment. We have restructured the business from our formerly siloed approach into client-centric retail, institutional and emerging markets divisions that enable a cross-cutting view of clients. This allows us to offer our clients a comprehensive range of solutions across our institutional and retail portfolios in South Africa and other emerging market countries.

| Supporting our focus on our clients’ financial well-being: our digitisation and modernisation strategy |

|---|

|

Our customer value proposition requires operational and technological excellence and we continue to develop and enhance our digital strategy in anticipation of customers’ needs. Our modernisation strategy entails the roll-out of online and mobile functionality, which will improve the user experience in line with our clients’ evolving digital preferences and expectations. We have budgeted approximately R1 billion over the next five years to support our digitisation and modernisation strategy. We expect to have a fully operational single group-wide view of our clients within three years. In March 2017 Alexander Forbes entered into an agreement with Sapiens International Corporation, a leading global provider of software solutions for the insurance industry. Under the agreement Sapiens will provide a wide range of offerings – including key components of the Sapiens Digital Suite – to power Alexander Forbes’s client proposition and enhance its digital capability. We look forward to the benefits that this new partnership will provide to our product and service offerings. |

A key aspect of our client-centric strategy is our ‘back in the boardroom’ member access strategy, which entails accessing retail members through our existing institutional client base. This requires that our institutional and retail teams work together to deliver high-quality solutions to both institutional clients and the potential retail members within.

The operations and technology division has embarked on a process of consolidating administration and technological support across all divisions. This process is giving the group a better understanding of the ways we currently serve our clients while highlighting areas of opportunity. It allows us to extract maximum value out of technology investments, and also frees up the retail, institutional and emerging markets divisions from administration and operational support so that they can be wholly client-focused.

In June 2016 we brought in-house the administration of beneficiary funds and trusts, which has enabled us to expand our offering from consulting to support and administrative services. This better positions Alexander Forbes to provide financial services to the market in a broader way, creating opportunities for new business and new revenue.

A new group public sector division has been created as a strategic enabler to support the group’s vision and growth initiatives in the public sector across the institutional, retail and emerging markets divisions. The division will work in close collaboration with our key partners, Mercer and ARC.

During the year we also streamlined our investment capabilities within Alexander Forbes Investments (previously Investment Solutions), creating a single, centralised division of investment experts within the group and integrating the advice, implementation and management aspects of our asset management business. We are confident that the revised structure will unlock value and better position us to serve our institutional customers with an integrated value proposition.

Our emerging markets business – like the rest of the group – has undergone a year of restructure and consolidation. We have focused on repositioning the business for a weaker corporate market by concentrating on the SME and retail markets.

Performance summary

| Indicator | Change | 2017 | 2016* | 2015* |

|---|---|---|---|---|

| Total number of institutional clients | 0%  |

4 939 | 4 923 | 4 638 |

| Total number of members under administration | 12%  |

1 297 020 | 1 479 405 | 1 447 872 |

| Total number of retail clients | 6%  |

142 330 | 134 142 | 129 501 |

| Institutional client retention rate (%) | 0%  |

97 | 97 | 97 |

| Retail client retention rate (%) | 1%  |

85 | 86 | 86 |

| Net promoter score (NPS) for umbrella fund clients in South Africa (rating from -100 to 100) | 18%  |

65 | 55 | 47 |

| Financial well-being (number of financial well-being days) | >100% |

146 | 7 | – |

| * Prior-year numbers have not been restated for discontinued operations. | ||||

During the first three quarters of 2017, to address a very challenging economy and competitive environment, our focus within the institutional division was client retention. We revisited and refreshed our pricing model and enhanced our umbrella fund offerings. This paid off, allowing us to maintain our strong levels of client retention at 97%. We also gained 162 new institutional clients (2016: 211) in a competitive environment.

Although Alexander Forbes Investments lost a significant client during the year client retention remains high, with a 92% retention rate of institutional clients and a 95% retention rate of institutional assets under management (AuM). The business also gained R9.9 billion of new asset management business from several high-profile clients, with closing investment AuM increasing by 3.2% (a 3.1% increase in institutional AuM and a 3.9% increase in retail AuM).

Having successfully consolidated our public sector strategy at the institutional level, we will now move to position this enabler team at group level. The challenges presented by an unstable political climate and a lack of decision-making within the public sector limits our ability to move forward with new projects, however, our plan is to remain adaptable and to leverage our brand positioning and strategic relationships to convert our sizeable pipeline for new business growth.

Institutional client retention rate: 97%

Retail client retention rate: 85%

Alexander Forbes Health maintained a client retention rate of 98% on its broker business. A significant portion of health revenue faces regulatory constraints on medical schemes commission, but over the last three years the business has benefited from inflationary increases to this cap. Following the loss of a significant public sector client in 2016 the focus of the health business has been on repositioning the health risk management section to a smaller and leaner operation. The business model was successfully redesigned to a variable cost model, which incorporates the use of independent contractors.

The retail side of the business faced a particularly difficult year in 2017, realising only muted growth in revenue. While we retained profitability by reducing expenses, we did not invest sufficiently in the year under review, particularly in our sales force. However, the wealth business increased clients by 8% to 61 907 clients at year-end. Client retention at wealth and investments remained high at 85%, although we continue to experience partial withdrawals of investments by clients. Assets under advisement grew by 4% to R64.7 million and assets under administration increased by 3% to R59.8 million. Average retail assets under management grew by 7% to R51.6 million.

Within Alexander Forbes Life retail we are pleased to have gained 1 411 new clients and notable growth in new business. The business remains sub-scale and in the year ahead our focus will be on increasing sales into our institutional member base.

AF Insurance, our short-term insurer, increased clients by 2% to 81 306. Lapses were higher than budget in the year at 20%, partly due to the focus on multi-claimants as part of initiatives to reduce the loss ratio. The financial loss ratio for the year was 71.5%, below the 72% target. Interventions during the year focused on better underwriting rules, risk pricing and procurement.

Our emerging markets business lost a major public sector client, the Botswana Public Officers Pension Fund, due to the client insourcing its pension administration. The loss was anticipated, and we were able to prepare by taking corrective action. In addition, excluding the loss of that client, our member base in emerging markets grew 10% in 2017, indicating that our core strategies are working.

Building our brand

The Alexander Forbes brand is associated with trust and expertise, backed by solid performance and service. We serve a diverse array of clients, each with unique needs and interests. While the institutional market is deeply relationship-based, the retail sector requires quick adaptation to fast-moving consumer demands, while strengthening relationships with the individual. The public sector is characterised by long lead times, frequent turnover and requires significant investment in relationship-building.

We continued to reinforce our brand and maintain our thought leadership position within the financial services sector through targeted interventions and consistent media engagement.

During 2017 we focused on mapping the Alexander Forbes customer lifetime journey with the intention of better understanding our clients and their priorities. We also moved to centralised measuring and tracking of our customer experience – a function that previously fell within the domain of each division.

| Awards won in 2017 |

|---|

|

Alexander Forbes takes pride in building our reputation through the merit of our solutions and service. During 2017 we won the following awards:

|

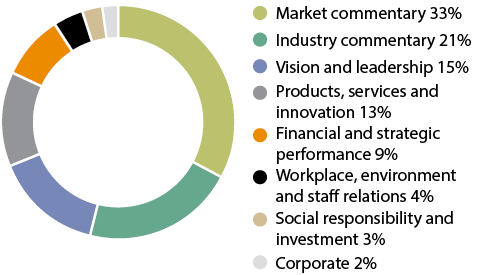

In 2017 Alexander Forbes was mentioned in a total of 2 780 media items across print and broadcast media platforms, with an advertising value equivalent of R101 million.

About 63% of these media items were classified as thought leadership pieces.

Delivering a holistic solution

While our retail and institutional divisions pursue different types of clients, we are cognisant that serving one client base well impacts our ability to access the other and vice versa. Institutional members that have had a good experience with Alexander Forbes will be more inclined to turn to the group for individual advice and products, and satisfied retail clients will be more likely to advocate to their employer for our institutional products.

This year we intensified our financial well-being days – in both number and scope. Learning from the experience of our pilot in 2016, we lightened the offering in 2017, making the days lower cost and easier to set up. We also partnered with debt counsellors to provide debt counselling services during those days. In 2017 we held 146 well-being days, at 138 employers, which generated 2 139 leads. We also continued with our ongoing on-demand member education services at our institutional clients.

In 2018 our target is 100 financial well-being days and 100 digital well-being campaigns. These will drive financial well-being online and digitise our customers’ journey. Initially we will use campaign codes to direct potential customers to our website, allowing them to access the financial well-being journey. Thereafter we will provide ongoing digitally-based interventions, education, awareness and solutions.

Ensuring a quality experience

Customer experience is increasingly becoming a differentiator as products become more commoditised and financial services are no exception. Alexander Forbes has identified this as an opportunity to enhance our competitiveness. As such, client satisfaction is critical to our business. We measure it predominantly through net promoter scores (NPSs) and client retention.

All our employees are expected to diligently attend to clients’ needs and meet expected service levels, including responding to all concerns or queries on the same business day. We are comfortable that our clients are satisfied with our service, but competition remains a challenge and as such we strive constantly to improve our service and enhance our overall customer experience.

The NPS is a key customer satisfaction measure. It measures customer likelihood to recommend Alexander Forbes based on an interaction with us, both at the end of an interaction as well as at a relationship touchpoint. NPSs range from -100 to 100, with scores over 50 considered excellent. The score is generated monthly to monitor and manage operational activities.

| Stakeholder profile |

|---|

| Joanne Janse van Vuuren Retail client |

|

Joanne’s first association with Alexander Forbes was in 1999, as the group administered her then employer’s pension fund. Happy with the service she was receiving she then consulted an Alexander Forbes financial planning consultant (FPC) to discuss her personal investments. Upon retiring in 2014, with the assistance of her FPC, Joanne transferred her employee provident fund to an Alexander Forbes provident preservation fund, which she still has. Her same FPC manages her other investment portfolios with other investment houses. ‘I find Alexander Forbes very professional. I have a good feeling that my funds are well managed. They send me quarterly updates on my portfolio (although I can get these more regularly if I go online, which I don’t require). Most importantly of all, my FPC is accessible at any time. He meets with me once a year to go through my portfolio, although I can meet with him more regularly if I wish to.’ |

| Net promoter scores | 2017 | 2016 | 2015 |

|---|---|---|---|

| Relationship NPS measure* | |||

| Umbrella fund clients | 65 | 55 | 47 |

| Consulting | 52 | 46 | 47 |

| Transactional NPS measure** | |||

| Operations and administration | 49 | 43 | 26 |

| AF Individual Client Administration (AFICA) | 57 | 53 | 53 |

| Financial planning consultants (FPCs) | 70 | 59 | 71 |

| AF Insurance (AFI) | 42 | 36 | 31 |

| * | All existing customers are asked to indicate their likelihood to recommend AF. |

| ** | Based on a recent interaction with AF customers are asked to indicate their likelihood to recommend AF. |

Our NPSs have shown a positive trend in 2017, which we attribute to increased service efficiency and a focus on customer service. We did not set specific targets for our NPSs in 2017, but we plan to set targets in 2018 that will include both NPSs and other customer satisfaction measures.

In 2017 Alexander Forbes Insurance participated for the first time in the South African Customer Satisfaction Index (SAcsi), an independent national NPS benchmark of customer satisfaction of the services and products available to South African consumers. The index is based on a cause-and-effect model, which measures cumulative customer satisfaction as a result of customer expectations, perceptions of quality and perceptions of value. SAcsi findings indicated that our customers are loyal and have high expectations. Alexander Forbes Insurance scored above NPS industry average, scoring 31% (NPS industry average: 24%) and was placed second on the SAcsi NPS ranking.

| Alexander Forbes Investments client satisfaction |

|---|

During 2017 Alexander Forbes Investments conducted its fourth independent client survey, run by Confluence. The survey assessed the opinions of consultants and trustees and culminated in a single metric that measures performance and allows Alexander Forbes to monitor client satisfaction in key areas. Our ratings in four major areas were as follows (with our score indicated in brackets):

Our overall excellence score was 75%. Most of our scores were lower than in 2016, but were still considered high. Scores between 51% and 75% are considered acceptable, and scores over 75% are exceptional. We were pleased that when asked during the survey for the first thing that came to mind about Alexander Forbes Investments, most people (62%) had positive comments, such as ‘efficient’, ‘reliable’, ‘innovative’ and ‘trustworthy’. Declines in the metrics must be seen in the context of a general economic low point, and we are comfortable with our performance, although we will always strive to improve where we can. |

Treating complainants fairly is at the core of the complaints management framework. We commit to ensuring that each is acknowledged within 24 hours and resolved timeously and efficiently. For 2017 we are pleased to report that our complaints management process has matured and become more centralised.

We have an ‘omnichannel’ approach to logging complaints: online via the website, via telephone, social media platforms, e-mail, fax and post. The majority of our complaints are resolved within five working days. The resolution of a complaint is not only a valuable opportunity for improvement in processes and service, but can also result in an increase in customer satisfaction. Our goal is to increase our logging of complaints as these are an invaluable source of client information to the business.

| Alexander Forbes Insurance complaints | 2016 | 2015 | 2014 |

|---|---|---|---|

| Ombudsman for short-term insurance – AFI | |||

| Number of complaints | 108 | 112 | 179 |

| Overturn ratio | 13.89% | 14.06% | 26.79% |

| Ombudsman for long-term insurance – AF Life | |||

| Number of complaints | 10 | 10 | 7 |

| Wholly or partially in favour of the complainant | 3 | 1 | 3 |

AFI’s total number of complaints to the ombudsman and share of total complaints reduced in 2016. The reduction is indicative of an improved and effective internal complaints-handling process. AF Life’s contribution to the share of the total number of complaints was minimal for both years. The majority of complaints related to repudiated claims. Complaint trends in the retirement or employee benefit space indicate that customers would prefer proactive communication during the withdrawal claim process. We have initiated measures to improve customer communication in this regard.

Optimising distribution channel strategy

As the group adopts a client-centric view, it is important that our products are sold accordingly. To this end our unified sales and service centre went live on 1 April 2016 and our salespeople have been reorganised into pods, each of which sells an entire customer solution. These pods create a cross-selling lead source as part of the group’s move towards offering integrated and holistic advice.

Outside of this lead source, distribution channels continue to run independently. All consultants undergo extensive training to equip them to convey the value represented by the group in its entirety as opposed to a specific product or service.

The AF Life business has increased the distribution capabilities in both the internal call centre and the tied agency.

These channels reached capacity during 2017 and have been successful in driving new business flows. The total life policy sales of 2 469 policies is an increase of 267% over the prior year.

In 2017 we continued the roll-out of our retail sales academy, deepening our employees’ understanding of the nature of the retail market, and developing sales and business management skills. We intend that our retail academy will facilitate the accreditation of our salespeople. Certificates are awarded for sales training, management training and service training.

Our products and services are distributed through the following channels:

- Tied agents

- Multi-tied agents

- Independent financial advisers (IFAs)

- Brokers

- White-labelling partnerships

- Outbound call centre distribution

- Internet (self-service)

Maintaining our position of thought leadership

We pride ourselves in offering our clients education, advice and products that are in line with global best practice. In a rapidly evolving environment, maintaining our reputation for thought leadership is an important means to securing client and investor trust.

Our series of thought leadership publications helps current and potential clients to understand the latest developments within the financial services sector and the associated implications. Benefits Barometer, for example, provides an annual review of South Africans’ savings, particularly the role that employee benefits play in social protection and financial well-being.

In 2017 approximately 63% of media coverage about Alexander Forbes was assessed as thought leadership. The graph below outlines which areas/reputational drivers received the most commentary in the media.

Reputational driver % of total media commentary

Developing innovative financial products and services to meet clients’ needs

Remaining competitive requires that we continually adapt our products and services to the changing environment, and develop new solutions to meet new opportunities. This entails both enhancing our product offerings, and increasing our digital and technological capabilities so as to provide superior client services and experience offerings.

| Strategic international and local partnerships for enhanced client offerings |

|---|

|

Mercer Africa Limited, Alexander Forbes’s largest shareholder since 2014, is founded on the idea that benefit and retirement programmes that are tailored to individuals also produce results for their employing organisation. Our partnership with Mercer exposes Alexander Forbes to cutting-edge international approaches to client-orientated solutions, significantly enhancing our service offerings to our clients. African Rainbow Capital (ARC), a 10% shareholder of Alexander Forbes Limited since January 2017, is a significant new empowerment partner. Our partnership with ARC will assist in our SME penetration strategy in South Africa as well as expansion into core and new markets within Africa, particularly the public sector. This will enable us to achieve our 2022 double-digit growth ambition and firmly take our position as a distinctive pan-African financial services provider. |

In June 2016 we launched our new retail retirement annuity product: ‘Just Retirement with Profits’. This is a simple non-underwritten living annuity product with profit, launched in partnership with Just Retirement. The product has placed R105 million in premium business to date.

During 2017 Alexander Forbes Financial Services launched InFund Solutions – the InFund Preservation and InFund Living Annuity – for its umbrella fund members. This marks a significant evolution for the division’s flagship product, allowing members to preserve their money within the fund despite changes in circumstances. This provides substantial benefit to members, who will now have one solution as they change jobs, build up their savings and eventually retire. The result is a retail product at the price of an institutional product.

Between the launch in September 2016 and 31 March 2017, 147 members have utilised the InFund Preservation solution, keeping their money in the fund upon leaving their employer. A further 40 members chose to receive a living annuity from the fund through the InFund Living Annuity.

This product is a seamless solution across the institutional and retail divisions – a classic example of retailisation, where we have moved the focus from the institution to the individual. In addition, this enhanced solution is in line with National Treasury’s retirement reform proposals that ask trustees to guide members through the retirement process.

The retail division will launch the AF Life age-rated premium pattern onto its products. We have also recently launched a new retail product: the Alexander Forbes Retirement Income solution. This has been designed to meet the recommendations of the proposed retirement funds’ default regulations. The product leverages our strong institutional relationships and will be taken to the boards of trustees of our advised and administered retirement funds, with the intention that it forms part of their default annuity strategy. The product is favourably priced, with increased customer longevity and higher capture potential driving asset accumulation, which is core to achieving the group’s 2022 ambition.

We also focus on continuously refreshing existing products and solutions, such as Life Gauge – a consulting tool currently used by 615 of our institutional clients. We have developed and are currently testing our new version of Life Gauge, which includes a number of enhanced features, which we anticipate will be operational by August 2017.

We have also successfully partnered with three advisory/ consulting houses to create solutions. These partnerships have resulted in additional AuM of R4.2 billion to date, with another R11 billion in the pipeline.

| Investment Solutions’ Public Sector Money Market Unit Trust |

|---|

|

This portfolio is a new investment solution for the public sector, aimed at municipalities and other public sector entities that hold cash. It is a money market portfolio that seeks to preserve capital, enhance yield and provide immediate liquidity, while being cognisant of the investment limitations applicable to public sector entities. The portfolio complies with the prudential investment guidelines applicable to the Municipal Finance Management Act (MFMA) and the Public Finance Management Act (PFMA), and is managed on a multimanager basis, which means we select and combine different asset manager portfolios, aiming to provide the most efficient return. |

In the rest of Africa, we focused on shifting clients from standalone funds into umbrella funds, where our ability to service the members and cross-sell is much greater.

One of our new product strategies has been to enter the small- and medium-sized enterprise (SME) market, targeting businesses that employ 50 people or less. Within the first three months of the launch of this strategy we acquired 21 new SME clients across Africa.

| Stakeholder profile |

|---|

| The Industrial Development Corporation (IDC) Public sector client |

|

The IDC is a State-owned enterprise, established in 1940 as a national development finance institution intended to promote economic growth and industrial development. The IDC entrusts Alexander Forbes with various aspects of its financial advisory requirements: retirement and pension funds, health and medical aid, investments and insurance, as well as several of our retail products. |

Looking ahead

Despite the challenging environment, which required significant internal focus during the year to reorientate to a more client-centric and integrated operating model, by the last quarter of 2017 we were able to start focusing externally with the launch of a number of new solutions and innovations, setting the platform for the years ahead.

Looking ahead to 2018, we will continue with our client-focused strategy and financial well-being to better understand our clients’ unique needs and circumstances. Our aim is to reach a position where we interact regularly on-site with our corporate and institutional clients so as to engage face to face with their employees.

In terms of our distribution strategy, our immediate aim is to move away from multi-tied agents to tied agents, so that our sales force sells only Alexander Forbes-approved products, under our branding. We are also building the basis of a targeted independent financial adviser (IFA) distribution channel strategy that will enable a focus on IFAs and brokers across both the retail and institutional divisions.

Within AF Investments we intend to arrange and articulate our current set of product portfolios to better meet our clients’ needs. The retail and investments teams are working together to develop a new IFA strategy and build the investment capability to support that.

In the public sector we are changing the way we build and maintain government relationships in order to cushion the group against political volatility. One way in which we intend to drive this is through strategic partnerships and alignments with smaller, empowered entities.

Looking ahead, our focus will remain on our retail access strategy and demonstration of our customer value proposition at an individual client level. Our clarified strategy allows for better execution and better implementation of an integrated and holistic customer value proposition through innovative products and services. As the group settles into its new structure, we can focus our energies on implementing the modernisation programme, as well as innovation and research and development, to improve our client offerings.