Our external

operating context

Political environment

The operating environment remained challenging for the financial services sector, with Brexit, the US election and President Trump’s economic policies having a negative impact on the South African economy. More critically, South Africa remained in a state of transition with continued uncertainty around the country’s macroeconomic outlook.

On 30 March 2017 President Jacob Zuma reshuffled his cabinet, which included the removal of finance minister Pravin Gordhan and his deputy, Mcibisi Jonas, from office. In quick succession the rand weakened against major currencies – having strengthened over the last few months – and the government of South Africa’s debt rating was downgraded by Moody’s, Fitch and S&P.

The political environment in most of the countries in which emerging markets operates is currently stable.

Going into 2018, Alexander Forbes, like other financial services organisations, is expected to be impacted by ongoing economic and political uncertainty which will impact consumer and business confidence. Slowed business growth and a weak rand will further hamper growth in short-term insurance businesses in South Africa and within our emerging markets businesses.

Economic environment

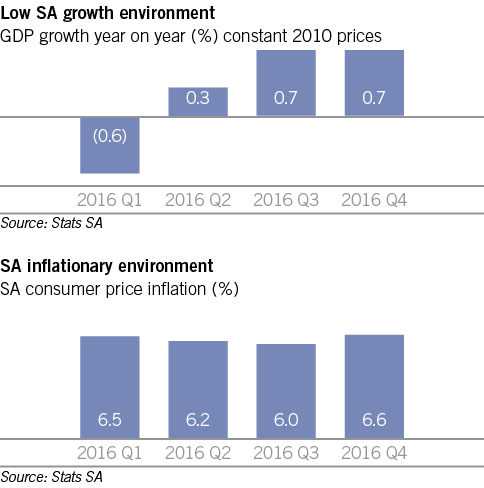

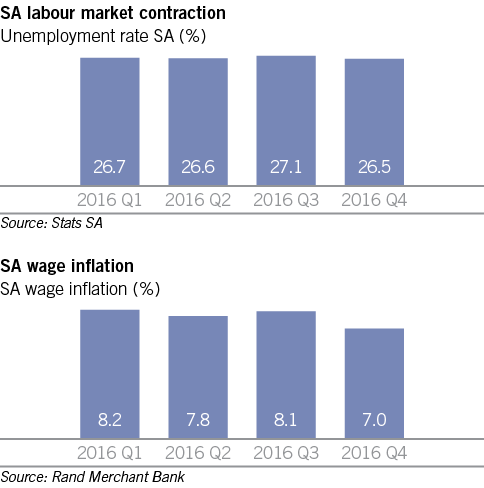

The economic environment has a direct correlation to our business model, particularly in the institutional clients business. One-third of our revenue has historically been linked to the financial markets and more than 50% of the trading result is also impacted by factors such as wage inflation, employment statistics and GDP growth, which are key indicators to recurring revenue lines. Stronger structural growth opportunities exist within our retail business lines, but with linkage to consumer confidence and sentiment.

2016 was a low growth year in South Africa; the economy grew just 0.3%, compared with 2015. At the end of 2016 unemployment was 2% higher year on year. The youth (aged 15 – 34) remain the most vulnerable in the labour market with an unemployment rate of 37.1%, which is more than 10% above the national average. Increases in unemployment have a strong correlation with funds being withdrawn from pension savings and declining member numbers, both of which affected us again this year. Wage inflation generally has a positive impact on our business as fees increase with increasing pension contributions.

According to the Old Mutual Savings and Investment Monitor confidence in the South African economy plummeted to 31% in 2016 from 55% in 2015 and debt levels have increased to 16% of income (2015: 12%). 41% of property owners consider their primary residence to be part of their retirement nest egg, and the use of pension and provident funds has decreased.

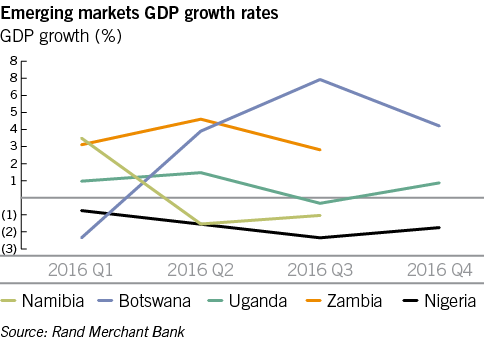

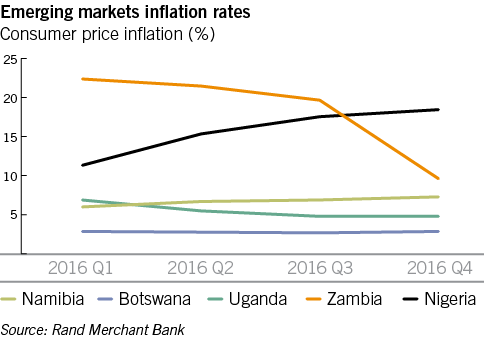

In the sub-Saharan countries in which Alexander Forbes has an established presence, economic growth has also been slow.

The uncertain and subdued economic outlook in South Africa and some of the other emerging market countries will continue to influence business performance across our retail and institutional businesses, as well as our ability to grow assets under management and associated fees. Risks include retrenchments in our client base, withdrawals from retirement funds, increasing incidents of disability claims, less discretionary money within households impacting purchasing decisions across protection and insurance solutions as well as discretionary investment products.

Competitive environment

The local financial services environment remains highly competitive with a large number of mature players and new entrants that are positioning themselves as either low-cost providers or aiming to simplify the client experience. Larger, mature providers are differentiating or modernising their product sets or looking to add additional value by combining services.

Employee benefits and retirement funds

The industry as a whole has experienced muted growth against the macro backdrop of slow economic growth and weak employment. Overall, there has been a trend of freestanding arrangements converting to umbrella arrangements. This has been driven by the desire of employers to simplify their arrangements and reduce the overall costs relating to the provision of retirement savings arrangements. We expect this trend towards umbrella funds to continue.

Within the umbrella industry there is increased competition with several new entrants into the market already having launched products, or announced plans to do so. We do, however, expect some market consolidation, given the need for umbrella funds to achieve scale to provide viable administration services and wider value-add services.

Other key issues are a focus by regulators on reducing costs and charges, increased transparency, and the introduction of new technologies. We therefore expect further reductions in charges as well as broad industry investment into new technologies that improve the customer experience.

Long-term insurance

Long-term insurers have also faced tough economic conditions in recent times. Slow economic growth and lower wage growth have resulted in less disposable income for consumers, resulting in reductions in new business, an increase in claims and an increase in lapsed policies. Several insurers have reported worse-than-expected morbidity rates, linked to economic conditions. The impact of this environment has been felt mainly by group disability income insurance schemes, as fewer claimants return to work. It is expected that this trend will continue for some time.

During the year muted equity returns continued to affect both policyholders and shareholders. A weak employment market, negative economic outlook and credit downgrades are expected to suppress future earnings.

Regulatory and legislative environment

As a group we are subject to a great deal of draft and new legislation and regulation. Key regulatory impacts that we are anticipating in the short to medium term are discussed below.

Financial Sector Regulation Bill 2016

Implementation of this Bill is aimed for April 2017 but it will be phased in over a few years. This Bill provides for Phase 1 of the Twin Peaks model of financial regulation for financial institutions. A Prudential Authority will be established to provide prudential regulation and a Market Conduct Authority to provide market conduct regulation of financial institutions. We have a good understanding of the requirements of the Bill and the attendant Levies Bill.

Conduct of Financial Institutions Bill (COFI)

COFI forms the basis of Phase 2 of the Twin Peaks model of financial regulation. In Phase 2 existing sectoral legislation will be reviewed, amended and ultimately replaced with COFI to ensure comprehensive governance of financial institutions. The aim is to table COFI in Parliament in the 2018 calendar year.

Insurance Bill 2016

This Bill consolidates the long-term and short-term prudential regulatory framework for long-term and short-term insurers and forms part of the Twin Peaks model. An implementation date in the second half of the 2017 calendar year has been proposed. The Bill deals with, inter alia: (a) financial soundness and oversight through higher prudential standards, insurance group supervision and stronger reinsurance arrangements; (b) micro-insurance; (c) strengthening of governance, risk management and internal control for insurers; and (d) alignment with international standards. Amendments are also being made to the Regulation and the Policyholder Protection Rules. This Bill will work together with the Taxation Laws Amendment Bill, which also gives effect to the Insurance Bill.

The Insurance Bill will impact on the long-term and short-term insurers in our business. We have provided our comment on the Bill and are required to understand its impact on our business with a view to making the necessary adjustments to ensure compliance and cohesion with strategy.

Retail distribution review (RDR)

A status update on RDR was published by the Financial Services Board (FSB) in December 2016. The 2016 update deals with the status of RDR Phase 1 regulatory instruments and the current FSB thinking on Phases 2 and 3. Phase 1 regulatory instruments include:

- general Code of Conduct for authorised financial services providers (FSPs) and representatives issued under the Financial Advisory and Intermediary Services Act (FAIS);

- determination of fit and proper requirements for FSPs under FAIS;

- financial advisory and intermediary services regulation issued under FAIS;

- regulations issued under the Long-term and Short-term Insurance Acts; and

- policyholder protection rules under the Long-term and Short-term Insurance Acts.

All of the above are in themselves significant pieces of new regulation, which we are coming to grips with. We have provided our comments on these and engaged with industry bodies where necessary.

RDR aligns to treating customers fairly (TCF) and introduces significant reforms to the distribution and intermediary remuneration landscape. It will lead to reduction in platform rebates and disruption in the independent financial adviser landscape. There are 55 specific proposals to be implemented in phases, 14 of which are destined for Phase 1.

The RDR proposals need to be carefully considered so as to ensure our strategies are achieved with maximum alignment to RDR, and much thought and action is required to ensure we maximise the effect of the RDR proposals as far as our strategies and customers are concerned.

Full information reuth Africa and within emerging markets – is available online in the full governance report.

www.alexanderforbes.co.za/investor-relations/integrated-reports