The unexpected global economic and political outcomes of 2016/17 caused considerable market instability and volatility. These events, coupled with local political disquiet, made it a challenging year for the financial services sector domestically. The pro-Brexit vote and President Trump’s economic policies have negatively impacted the South African economy. More critically, South Africa itself is in a state of transition. The upsurge in political activism through focused campaigns at tertiary educational institutions and in civil society, the recall from office of Treasury officials and the lack of clarity around government policy have resulted in uncertainty around the country’s macroeconomic outlook. The result was the downgrading of the country’s credit rating. The financial services industry is acutely sensitive to these macroeconomic factors, and the political and economic turmoil has contributed to a very tough trading environment across most sectors.

Learn More

Sello Moloko

Non-Executive chairman

Institutional clients

| Consulting |

| Retirements |

| Investments |

| Group risk |

Retail clients

| Wealth and investments |

| Retail insurance |

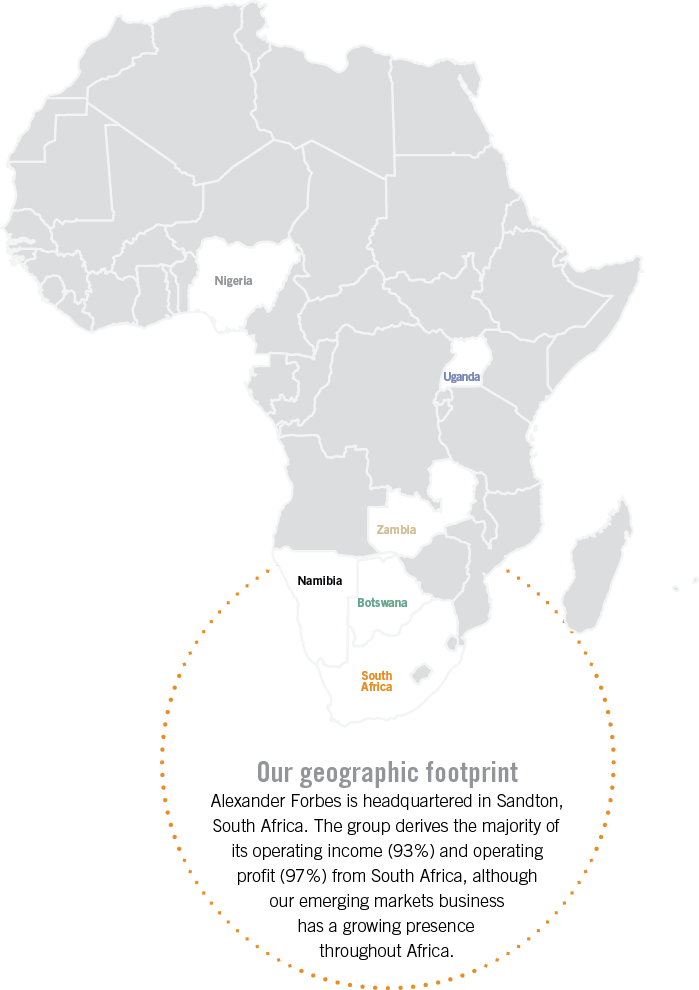

Emerging markets

| Southern Africa (Namibia, Botswana) |

| Eastern Africa (Uganda and Zambia) |

| Western Africa (Nigeria) |

Products and services

Products and services

Products and services

Clients

Clients

Clients

Group Operations, Technology and IT | Group Shared Services

Institutional

Retail

Our clients are the cornerstone of our strategy: they buy our advice-led solutions and provide our revenue

Learn moreThe Alexander Forbes board takes overall responsibility for investor relationships, ensuring investors have a sound understanding of the group’s value

Learn moreWe are committed to being a responsible corporate citizen with regard to our community, our society and our environment

Learn more

Alexander Forbes’s vision is to be a globally distinctive pan-African financial services leader. During 2017 we launched Ambition 2022, our refreshed five-year strategy that aims to achieve our vision with a client-centric model focused on helping our clients secure their lifetime of financial well-being. In order to reach our goals we need to come together as one, combining our efforts seamlessly across the group to create value for all of our stakeholders.

Our collective power as a leaner, more focused group is the force we need to deliver financial well-being to our clients. It’s time to believe in the power of one.

Some things in life is just better viewed on a big screen Please open this report on a tablet in landscape mode or bigger screen.