Our Clusters

Institutional |

Retail |

||||

Businesses |

Investment Solutions (IS) | AF Financial Services (AFFS) | AF Insurance (AFI) |

||||

Products and |

|

|

|||

| Clients |

Retirement fundsCorporatesPublic sectorTrusteesMedical schemesUnions and organised labourSMEs |

Individuals and dependants |

|||

|

KPIs |

South Africa

|

South Africa

|

|||

| Supporting our ambition |

While the institutional and retail clusters serve different types of clients, we believe that they are nevertheless closely linked. Our main strategy is to leverage our longstanding relationship and proven track record within the institutional base to build our retail client base. By providing holistic advice and solutions to individual members in the institutional funds we aim to support their financial well-being. Successfully doing so will also support our ambition of growing our retail business. This is complemented by our growth in the open market. |

||||

AfriNet |

Alexander Forbes International (AFIL) |

||||

|

Namibia | Botswana | East Africa (Kenya, Uganda and Zambia) | West Africa (Nigeria) |

UK | Ireland | Netherlands | Channel Islands |

Footprint |

|||

|

|

Products and services |

|||

Retirement fundsCorporatesSMEsPublic sectorIndividuals |

Small to large corporate clientsPension fund trusteesIndividuals (Channel Islands) |

Clients |

|||

|

|

KPIs |

|||

|

AfriNet represents the group’s geographic expansion into Africa, outside of South Africa. Its strength lies in its products and services that are proven in South Africa and tailored to local markets. |

Through AFIL, the group is a 60% partner in Lane Clark & Peacock, the UK-based actuarial consultant, which provides services in the UK and, together with its subsidiaries in Ireland and Netherlands, elsewhere in Europe. |

Supporting our ambition |

|||

Operations and technology |

|||||

|

The operations and technology cluster supports the group’s strategic ambition by driving operational excellence, technology enablement and efficiency through a single point of accountability. Its objectives include: |

|

||||

Shared services |

|||||

|

Shared services enhances the efficiency and effectiveness of key functions within the group, including HR, finance, treasury, risk compliance and governance, technology, procurement, facilities, insurance, payroll and marketing. |

|||||

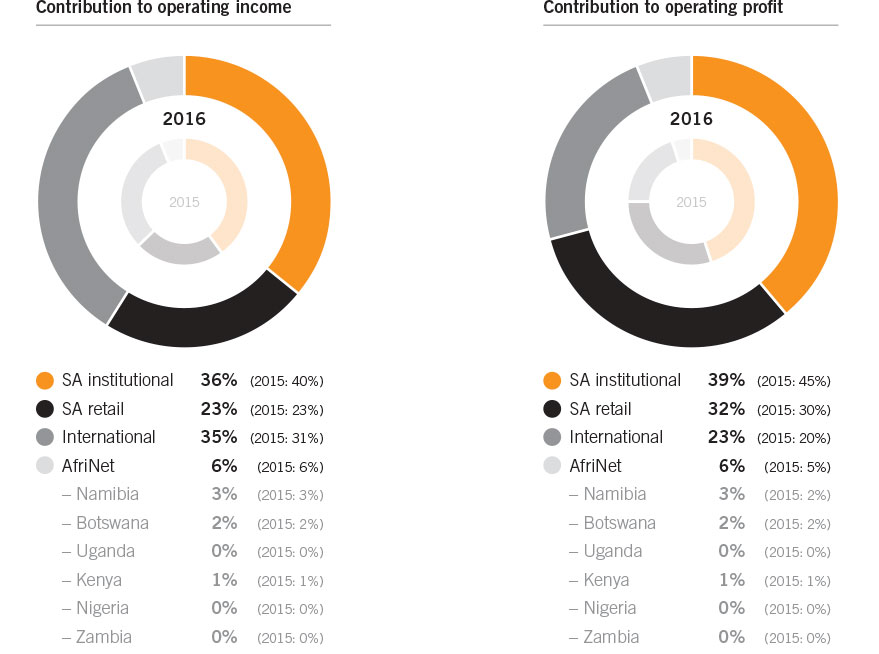

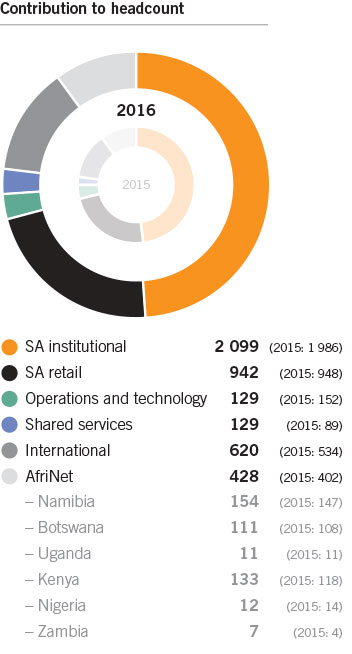

Cluster and geographic contribution

Each cluster supports our pursuit of our strategic intent in their own way. Our operating income and profit is derived from the institutional, retail and geo-centric clusters as illustrated below. The proportion of the workforce from each cluster is also shown below.

Alexander Forbes is headquartered in Sandton, South Africa, and derives the majority of its operating income (59%) and operating profit (71%) from the country. It is represented in the rest of Africa and Europe by AfriNet and AFIL, respectively.