Society

Highlights

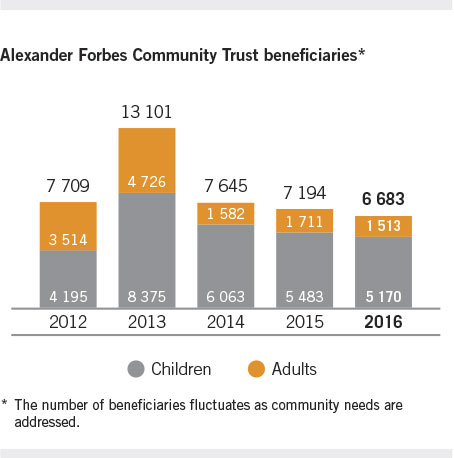

- The In-4-Life programme reached more than 6 600 beneficiaries and won the Sustainability Award at the 13th National Business Awards

- 17 asset managers assessed through Investment Solutions’ Manager Assessment and Ranking System (MARS)

- Alexander Forbes maintained its level 2 B-BBEE for the fifth time since 2012

- Electricity and water now measured at all Alexander Forbes sites

Challenges

- Continuous changes in B-BBEE legislation impacts on our long-term transformation strategies

- Developing objective measurement indicators for the community-based organisations supported through In-4-Life

Our approach

To Alexander Forbes, our responsibility to society encompasses the broader spectrum of stakeholders whose lives are indirectly touched by our operations. In fulfilling our higher purpose, we are committed to safeguarding our communities, contributing meaningfully to transformation, promoting responsible investment and minimising our environmental impact. Each of these commitments are managed separately according to need and relevance.

Our performance

Investing responsibly

Alexander Forbes views responsible investing (RI) as an investment practice that integrates factors that may materially affect the sustainable performance of assets, including those of an environmental, social and governance (ESG) nature. We practise RI primarily through Investment Solutions, our asset management and investment administration business. RI is overseen by Investment Solutions’ responsible investment committee, which is chaired by the company’s chief investment officer and has senior representation from various areas.

The company’s investment committee meets monthly and RI is a permanent agenda item. These meetings, together with other ad hoc meetings with the investment team, ensure RI remains a key focus within the investment process.

Investment Solutions is a signatory to the United Nations Principles for Responsible Investment (PRI) and endorses the Code for Responsible Investing in South Africa (CRISA).

Regulation 28 of the Pension Funds Act specifically states that prudent investing should incorporate the consideration of all factors that may materially affect the sustainable long-term performance of an asset. These include, but are not limited to, those of an environmental, social and governance nature. As stewards of our clients’ capital, Investment Solutions has a role to play in safeguarding our clients’ capital by ensuring that we, as well as the asset managers we select, consider and evaluate the risks and opportunities arising from the consideration of ESG factors.

The size of Investment Solutions’ asset base makes us an influential client to South Africa’s largest asset managers and we use this position to engage them on the subject. The manager research team researches, assesses and ranks local and global asset managers and through its Manager Assessment and Ranking System (MARS). The process scores factors such as people, process and philosophy to provide an overall assessment of the quality of an asset manager. ESG has been included as an explicit factor in this process. Investment Solutions does not exclude managers from the investment universe that score poorly on an ESG basis, but rather considers ESG as another factor to assess the quality of an asset manager. Ultimately, we are interested in asset managers’ ability to translate ESG discussions into good investment decisions and in the year under review, we assessed 17 asset managers through MARS. While this assessment had an equity-centric approach, the next year’s assessment will be expanded to include other asset classes.

We provide asset managers with detailed proxy voting guidelines in line with the requirements of King III, CRISA and PRI. Through our due-diligence process, we also consider aspects such as how they engage companies, the extent of their voting activity, as well as the systems they use to implement their strategies.

Stakeholder profile

Mark Lindheim, Investment Solutions chief investment officer

The company believes in achieving responsible and sustainable benchmark-beating returns (responsible alpha) by ensuring it, and the asset managers it selects, consider and evaluate the risks and opportunities arising from the consideration and incorporation of ESG factors.

We believe one way to evidence the quality of an asset manager is to assess its ability to consider, evaluate and address the softer aspects incorporated within an ESG lens.

We believe managers that consider sustainability issues when evaluating investment opportunities are more informed of the potential risks and opportunities related to the companies in which they invest in and are therefore better placed to deliver superior risk-adjusted returns and meet the needs of clients and society.

Actively implement transformation

Supporting South Africa’s transformation agenda is an important aspect of our responsibility to society. This means that we proactively seek opportunities to empower previously disadvantaged communities by investing in impactful community developmental initiatives. Beyond compliance and ‘the right thing to do,’ our commitment to transformation is an important component of our ability to win business and attract the best talent.

Transformation is overseen by the group’s social, ethics and transformation (SET) committee and is supported by each cluster’s respective SET committee. It is a permanent item on the group executive committee’s agenda and is included in senior management’s performance scorecards.

Alexander Forbes is assessed against the Financial Sector Codes and achieved level two empowerment status in its latest assessment conducted in September.

|

Financial Sector Code Performance |

||||

|

Target |

2016 |

2015 |

2014 |

|

|

Ownership |

14.00 |

16.24 |

14.16 |

15.16 |

|

Management control |

8.00 |

6.16 |

5.50 |

6.87 |

|

Employment equity |

15.00 |

9.17 |

8.32 |

8.32 |

|

Skills development |

10.00 |

9.00 |

9.01 |

9.42 |

|

Preferential procurement |

16.00 |

15.05 |

15.46 |

15.06 |

|

Empowerment financing |

15.00 |

Exempt |

Exempt |

Exempt |

|

Enterprise development |

5.00 |

15.00 |

15.00 |

15.00 |

|

Socio-economic development |

3.00 |

3.00 |

3.00 |

3.00 |

|

Access to financial services |

14.00 |

12.73 |

10.55 |

11.68 |

|

Overall score |

100.00 |

90.89 |

87.01 |

88.96 |

|

Empowerment contributor level |

2 |

2 |

2 |

|

Ownership

Based on the principle of continuing consequences, following our listing we retained an effective verified black ownership of 38.89%. One important consequence of our listing was that our empowerment equity partners, including Shanduka, the Staff Share Trust and the Alexander Forbes Community Trust, all realised value at the time. The Trust reinvested in the business and is categorised as a broad-based scheme in terms of the B-BBEE legislation.

In April 2015, we announced an employee share ownership scheme (ESOP) which has transferred an effective 2.9% ownership in the group to employees in South Africa. The scheme favours black women employees who are the beneficiaries of 70% of proceeds paid by the ESOP. This is a continued commitment to economically empower black women in line with the B-BBEE scorecard. Thirty per cent of dividends will initially accrue to the trust, the balance being utilised to repay the notional vendor finance extended to the trust at an interest rate of 7%.

Management control

Management control measures diversity on the group board and executive committee. During the year, we received 6.16 out of 8 available points for this scorecard element, down slightly from 6.87 in the previous year. This was impacted by the resignation of former group chief executive Edward Kieswetter; the appointment of Vishnu Naicker, formerly group executive risk and compliance, to the role of MD of the group shared services and the appointment of Sugendhree Reddy to the role of MD of the retail cluster.

Employment equity

For our performance with regards to diversity and inclusion in the workplace, see People.

Skills development

Our skills development expenditure in 2016 was R34.3 million, of which approximately R23.1 million benefited black women and R36 300 benefited black disabled people (R24 500 black disabled women). We contribute to the fight against youth unemployment through our learnership and internship programmes, which expose participants to the financial industry while they gain work experience and mentorship.

For more on our efforts to develop our employees, see 'Ensuring continual development'.

Preferential procurement

In 2016, our total measured procurement spend was R888 million, of which R111 million went to suppliers with at least 50% black ownership. More than R44 million went to businesses with at least 30% black women ownership. As a result, the group received 15.05 out of a possible 16 points for the scorecard element, down marginally from 15.46 in 2015.

During the year under review, we undertook an initiative to identify preferred suppliers through our recently centralised procurement function.

Enterprise development

Our approach to enterprise development is two-pronged. Our most significant contribution is in the form of our partnership with the Association of Savings and Investments South Africa (Asisa) which was concluded in March 2015. A total investment of R12 million was made to the ASISA Enterprise Development Fund to be recognised over a period of five years.

In addition, during the year we initiated a supplier development programme in which we identified promising BEE suppliers in our supply chain following due-diligence and needs analysis processes. These suppliers could, once the due diligence is complete, be provided with capital investment, equipment and training.

Last, we continue to allocate space in our headquarters to certain BEE suppliers. In 2016 this equated to approximately R2.2 million in recognised enterprise development support.

Socio-economic development

Our efforts with regards to socio-economic development are executed through our corporate social investment (CSI) programme.

Contributing meaningfully towards social protection

Alexander Forbes is motivated by its higher purpose – to help people attain peace of mind through securing their financial well-being, now and in the future. We achieve this primarily through the advice and financial products we provide, but we are proud to extend our impact beyond our clients to support the broader well-being of society.

Community development through corporate social investment

We manage our CSI through the Alexander Forbes Community Trust. The Trust comprises six trustees including the chairman, Dr Ali Bacher. The trustees meet at least twice a year to review activities of the Trust and report to the company’s group social ethics and transformation committee.

Our flagship programme, In-4-Life, provides consistent and holistic support to orphans, vulnerable children and their families from early childhood development through to tertiary education. This includes assistance for school learners (by providing uniforms, stationery, meals and after-school care), tertiary scholarships and bursaries.

In 2016, 22 In-4-Life beneficiaries received tertiary bursaries. In addition to the financial support they receive from the company, bursars also benefit from mentoring and coaching with Alexander Forbes line managers and quarterly sessions addressing issues affecting youth. Furthermore, we launched the business partnership programme during the year, giving bursary recipients a partner in the company throughout their studies. The relationship carries through to an internship and often results in permanent employment. Our ambition is to create opportunities for individuals from disadvantaged communities to access the mainstream economy. The company has employed eight former bursars since 2010 and six are currently in the internship programme.

In-4-Life is administered by the Alexander Forbes Community Trust in partnership with non-profit organisations (NPOs) in nine communities across Gauteng, KwaZulu-Natal, the Eastern Cape and Western Cape. These partners report back to the trust on a quarterly basis through a web-based reporting system. In addition, trustees conduct two site visits per year to gauge the impact of the programme.

We are also committed to supporting our NPO partners. Through our annual capacity-building workshop, we help our partners to develop strategies for important issues such as governance, funding, marketing and proposal-writing.

Stakeholder profile

Lindiwe Modau is In-4-Life

I was born in Johannesburg’s Alexandra Township, and lost both my parents by 2004. When my grandmother passed away two years later, I was left without a guardian or an income.

I was fortunate to receive sponsorship by the King David School to help with school fees and other costs. I worked hard and, after preliminary exams, was the top commerce student with ten awards. When I heard of vacation posts offered by Alexander Forbes, I went for an interview and got the job. I showed my results to HR, and received assistance in securing a bursary from the company to study for a bachelors degree in business administration at CIDA City Campus.

In 2013 I started an internship with Alexander Forbes in the healthcare department. I was welcomed into an environment that not only cares about growth and development, but also stresses the impact of understanding our higher purpose. I was elected to the women’s forum and was the youngest junior board member in 2015. Throughout my experience with the company I have been mentored by Hloni Mphahlele, who has been a great influence in my success. The Alexander Forbes Community Trust has made a significant impact on me through In-4-Life.

During the year, the group contributed R5.0 million to the Trust (2015: R4.6 million). This expenditure is spent in South Africa and equates to roughly 1.2% of net profit after tax for the group’s South African companies. In addition to this direct funding, the Trust also holds a 0.3% equity stake in the group, translating into shares worth some R29.8 million. In 2016, the Trust received a total R1.2 million in dividends. The Trust’s support reached approximately 6 700 people during the year, of whom 77% (5 170) were vulnerable children. The number of beneficiaries fluctuates as community needs are addressed.

We encourage Alexander Forbes employees to get involved in supporting community initiatives including In-4-Life and in 2016, four initiatives were implemented with employees participating in various charity activities including Mandela Day.

Building financial well-being throughout society

Providing holistic financial solutions to our clients requires that our current and potential clients have sufficient knowledge to make appropriate financial decisions. Our member education unit continues to hold education sessions at various institutional clients to address relevant financial topics with members. In 2016, the group travelled more than 40 000 kilometres to deliver 1 341 presentations, providing financial education services to over 22 000 individuals.

Over more than 80 years in business, Alexander Forbes has amassed substantial experience in the financial services sector, and we continue to use this institutional knowledge to positively impact the societies in which we operate. Senior managers at Alexander Forbes Financial Services regularly consult at various levels of government, not only on the financial wellness of their employees but on important matters of policy and best practice in asset administration and management.

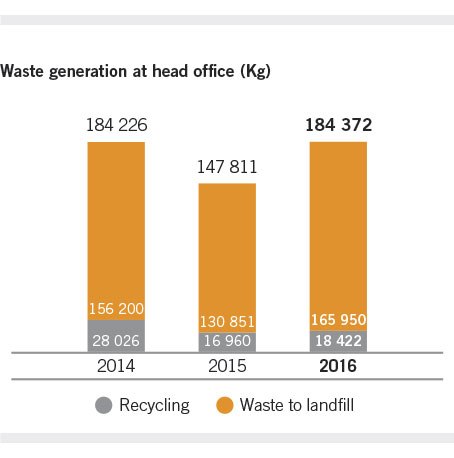

Environmental stewardship

While our business has a limited environmental impact, we are committed to safeguarding natural resources as far as possible. Our greatest impacts lie in the electricity and water consumed in our buildings as well as the general office waste generated through the course of doing business.

Our head office in Sandton was carefully designed to reflect South Africa’s abundant natural resources, and to respect and preserve these over the course of its use. The building incorporates the latest technologies and systems for incorporating ambient light and air to minimise the electricity used for lighting and cooling. Its four-star green star rating by the Green Building Council of South Africa was renewed during the year.

South Africa continues to face power shortages, and in 2016 we used approximately 66 700 litres of diesel to power our generators, up from 39 500 litres in 2015. In total, these generators ran for 61 hours – nearly twice the 32 hours they ran in 2015. While this energy is less efficient than that purchased from the grid, it is nevertheless an important business requirement in order to ensure business continuity during load shedding and other power outages.

Our data centre’s energy efficiency profile is measured in terms of a power usage efficiency rating. In 2016, it remained at 1.6, well ahead of the industry norm of 3.0.

During the year, we improved our ability to measure our water and electricity consumption beyond our head office. We now include actual consumption figures for our larger sites, and estimated data for the offices in which we maintain a smaller presence. Going forward, we hope to include all South African sites in our environmental data.

Electricity consumption at our head office grew 29% from the previous year, reflecting factors including increased occupancy in 2016, impacted by the move of Investment Solutions into the Sandton building.

The severe droughts in South Africa reduced the water gathered from our grey water system during the year. As a result, our municipal water consumption increased 19% to 46 783 kl at our headquarters (2015: 39 284 kl).

Our head office remains the only site in which we have been able to implement a recycling and waste measurement programme. The total volume of recycled waste increased 9% to more than 18 400 kg (2015: 16 960 kg).

On 19 March, all Alexander Forbes offices participated in the global Earth Hour campaign by turning off their lights for one hour in support of a lower carbon future. Employees were also encouraged to participate with families and friends.

Looking ahead

In the coming year, we plan to establish baseline data for the group’s South African water and electricity consumption beyond our head office. This will give us a sound base from which to consider plans to reduce our future consumption. While measurement limitations have precluded the group from quantifying its carbon footprint to date, we hope to be able to do so in the near future.

We are planning to implement a monitoring and evaluation framework to empower our community-based organisation partners with practical tools and methodologies to measure progress and optimise their interventions’ impacts.