Governing our Business

Fulfilling our higher purpose

At its core, Alexander Forbes exists in order to fulfil its higher purpose: helping people attain peace of mind by securing their financial well-being, now and in the future. We do this by helping them to create, grow and protect their wealth through expert advice backed by leading financial products.

The transition to our new cluster structure has helped us to fulfil our higher purpose by more closely aligning our employees and businesses with the needs of our clients.

Alexander Forbes believes that the application of the principles of good governance as contained in the King Code of Governance Principles and the King Report on Governance 2009 (King III), are a cornerstone of the Alexander Forbes business.

To ensure that our operations are executed in accordance with these principles, we have established a management system that includes a compliance framework, code of ethics, as well as policies and protocols to govern processes and operations.

The governance framework is applicable to all of the group’s subsidiaries in addition to those policies and procedures that are specific to certain subsidiaries.

Our board of directors

Alexander Forbes has a unitary board. Its primary mission is to effectively represent and promote the interests of the company’s shareholders and relevant stakeholders by adding value to the company’s performance.

The board is responsible for ensuring that the group’s operations, processes and activities are underpinned by a strong system of governance that is fully integrated into all aspects of its business. It remains accountable for the ongoing sustainability of the group.

The board met six times during the period under review with an average attendance of 90%. Meeting attendance is reflected in the table below:

|

Meeting dates |

||||||

|

Board member |

16 Apr 2015** |

4 Jun 2015 |

11 Aug 2015** |

4 Sep 2015 |

26 Nov 2015 |

11 Mar 2016 |

|

MS Moloko (chairman) |

√ |

√ |

√ |

√ |

√ |

√ |

|

M Collier (Lead independent) |

X |

√ |

X |

√ |

√ |

√ |

|

D Anderson |

X |

X |

√ |

√ |

√ |

√ |

|

E Chr Kieswetter |

√ |

√ |

√ |

√ |

√ |

n/a |

|

D Konar |

√ |

√ |

√ |

√ |

√ |

√ |

|

H Meyer |

√ |

X |

√ |

√ |

√ |

√ |

|

WS O’Regan |

√ |

√ |

√ |

√ |

√ |

√ |

|

DM Viljoen |

√ |

√ |

√ |

√ |

√ |

√ |

|

B Petersen |

√ |

√ |

X |

√ |

n/a |

n/a |

|

RM Kgosana |

n/a |

√ |

√ |

√ |

√ |

√ |

|

BJ Memela |

n/a |

n/a |

√ |

√ |

√ |

√ |

|

** Special board meeting. |

||||||

Board charter

The purpose of the board charter is to regulate how the board conducts business in accordance with the principles of good corporate governance. It sets out the specific individual and collective roles and responsibilities. The board charter contains a policy evidencing a clear balance of power and authority at board level to ensure that no one director has unfettered powers of decision-making. The charter requires the board to provide leadership and vision to the company in a way that will enhance shareholder value and ensure the group’s long-term organisational health. The full charter is available on our website at www.alexanderforbes.co.za.

Key focus areas in 2016

The board maintains an annual work plan in which it addresses regular items for the year and plans for additional specific matters to be attended to according to the schedule. This includes governance and committee reports, strategic reviews and detailed reports from the group chief executive and group chief financial officer.

Further matters included:

- Oversaw a BEE transaction establishing a trust and providing financial assistance in order for the trust to acquire 2.9% of the company’s share capital for the benefit of employees and particularly black female employees.

- Continued to review, update and adopt policies to strengthen the group’s governance and compliance frameworks.

- Appointed an additional independent director with due regard to the board’s required skills, mix and demographics.

- Recognised and discussed the shortfall in gender representation on the board.

- Approved the integrated annual report, annual financial statements, interim report and dividend.

- Conducted the annual JSE compliance review, the annual review of its terms of reference and work plan and the annual review of the group authorities matrix.

- Reviewed the board committees’ terms of reference.

- Received regulatory briefings.

- Reviewed and approved the annual budget.

Evaluation

During the year, the board and its committees performed self-evaluations in compliance with the King III. These covered the company and its significant subsidiaries, and included the utilisation of the Governance Assessment Instrument during the year under review. The resulting reports were presented to the relevant boards and audit committees. The board is considered to be effective in size and composition, with an appropriate balance between executive, non-executive and independent directors, thereby enabling objective decisions and internal processes. The company’s report in terms of King III can be found on its website.

Board composition

At the date of issue of this report, the company’s board of directors consisted of nine members. Of these, five were independent directors, two non-executive directors and two executive directors.

The board is made up of individuals with a range of skills and experience, collectively suitable to carry out the board’s responsibilities. They are involved in all material business decisions, enabling them to contribute to the strategic and general guidance of management and the business. Prior to their appointment, directors undergo an assessment in terms of the group’s fit and proper process. All new directors are introduced to the group through a comprehensive induction programme. The directors have access to management whenever required.

With the resignation of the group chief executive on 8 February 2016, it was agreed that the group chief financial officer also assume the role of interim group chief executive while the process of identifying a suitable replacement is completed. The JSE provided a six-month dispensation exemption that allows the same person to fill these two positions. However, due to the demanding nature of the roles, the board agreed that it would be prudent for the chairman to provide greater support in the intervening period. Therefore, with effect from 8 February 2016, the non-executive chairman was re-designated as the executive chairman.

The lead independent director continues to perform this function. The biographies listed in this report reflect the directorships at the time of publishing.

Non-executive directors

William Simon O’Regan

Appointed: 31 July 2014

Qualifications: BusSci (Hons), fellow of the Faculty of Actuaries (UK) and fellow of the Institute of Actuaries (Australia)

Committee responsibilities: Member of the remuneration and nominations committees

Mr O’Regan is the President – North America region for Mercer, covering the US and Canada. Prior to this role, he led the EuroPac region for Mercer, covering Europe and Pacific (Australia/New Zealand).

Mr O’Regan’s global career has covered a wide range of financial services areas, including life and health insurance, pensions and investments. He was educated in South Africa, and spent eight years working for a number of life insurance companies in Ireland, Zimbabwe and the UK. Mr O’Regan then joined Mercer in London in 1988 and transferred to Melbourne, Australia in 1989. He was head of the Melbourne office from 1993 to 1996.

In 1996 he left Mercer to join Vanguard, helping to establish their funds management business in Australia. Mr O’Regan returned to Mercer in 1999, leading Mercer in Australia from 2000 to 2004, a period during which the Australian pensions market changed its character completely and Mercer was able to establish a market-leading position in bundled and packaged pension provision, including bundled investments.

From 2005 to 2009, Mr O’Regan was based in London, UK as CEO of Mercer UK and Mercer’s Europe region head. He led Mercer’s global Retirement business from 2009 to 2012, and led the EuroPac region from 2012 to June 2015. In July 2015, Mr O’Regan was appointed to his current role.

Mr O’Regan has a business science degree from the University of Cape Town, and is a fellow of the Institute and Faculty of Actuaries (UK).

David John Anderson

Appointed: 10 October 2014

Qualifications: Dip All, Dip SM, FASFA, FAIM, ANZIIF (fellow) CIP, AAMI CPM, MAICD

Committee responsibilities: Member of the social, ethics and transformation committee; member of the group capital oversight committee

Mr Anderson is a senior partner and president of Mercer's Growth Markets Region. He was formerly the market leader for Mercer in the Pacific spanning the firm’s business segments of talent, health, retirement, financial services and investments.

He is the Chairman for Australia for Marsh & McLennan Companies spanning the operations of Marsh, Guy Carpenter, Mercer and Oliver Wyman collectively with 2 600 colleagues in 10 locations.

Mr Anderson has qualifications in marketing, insurance, superannuation, management and more than 25 years’ experience working in the financial services industry in Australia, New Zealand, the South Pacific, Asia and recently Africa.

He is a Certified Insurance Professional, a Certified Practising Marketer and a member of the Australian Institute of Company Directors. He is a fellow of each of the Association of Superannuation Funds of Australia, the Australian Institute of Management, the Australian and New Zealand Institute of Insurance and Finance and an associate of the Australian Marketing Institute.

Mr Anderson’s career experience includes advising national and multinational companies and foreign governments on investment and retirement savings matters and leading professional teams and businesses in life insurance and financial services.

Independent directors

Mark Derrick Collier

Appointed: 1 August 2011

Qualifications: HND/BA Business Studies, Dip M, M Inst

Committee responsibilities: Lead independent director, chairman of the remuneration and nominations committees; member of the audit committee

Mr Collier is a business leader with an extensive international track record in developing and building financial services businesses both as a corporate executive, non-executive, senior adviser and as an entrepreneur in leading global companies.

His career spans 30 years in the retail and institutional sectors of the securities, asset management, wealth management, retail banking, pensions and financial services industries.

He is the former president of Fidelity Investments Advisor Group (US) president of Charles Schwab Europe and CEO of Schwab International (US). At Fidelity he sat on the boards of Fidelity Investments Services Limited and Fidelity Portfolio Services Limited. At Schwab he was a director of Schwab International and the European, Asian and Latin American subsidiary companies. Today Mr Collier is a non-executive director with companies in Africa and holds advisory board positions with companies in Brazil and Asia. He is also a Senior Adviser to a leading emerging markets private equity firm and as an entrepreneur is a founder of an early stage financial technology start up based in London and Asia.

Deenadayalen Konar

Appointed: 1 February 2008

Qualifications: BCom, PG Dip in Acc, CA(SA), MAS (Illinois, USA), Cert in Tax Law, D.Com, CRMA

Committee responsibilities: Chairman of the audit committee

Dr Konar is a chartered accountant and was previously executive director of the Independent Development Trust where he was, amongst other activities, responsible for internal audit and the investments portfolios. Prior to that, he was professor and head of the department of accountancy at the University of Durban-Westville. He also lectured to graduate students at various South African universities.

He is member of the King Committee on Corporate Governance, the Corporate Governance Forum, the SA Institute of Directors and the USA National Association of Corporate Directors (NACD).

Dr Konar is also an independent non-executive director of Sappi, Lonmin plc, Steinhoff International Holdings, and Chairman of EXXARO Resources.

He is the past chair of the Ministerial Panel for the Review of Accountants and Auditors in South Africa, leading to the publication of the Auditing Profession Act, 2005, part co-chair of the Independent Oversight Panel of the World Bank (2009 – 2010) and the past chairman and member of the External Audit Committee of the International Monetary Fund in Washington (2004 – 2007), as well as a member of the 2010 Safeguards Panel of the IMF, and a past ad hoc panel member of the Ethics Panel of the United Nations Ethics Committee.

Busisiwe Jacqueline "Totsie" Memela-Khambula

Appointed: 1 July 2015

Qualifications: BA (Social Science); Masters in Public Administration;

Committee responsibilities: Member of the social, ethics & transformation committee; member of the remuneration and nominations committees.

Ms Memela is a development activist and passionate mentor of young leaders and was appointed group CEO of WDB Trust in January 2016. WDB Trust is a Public Benefit Organisation which mobilises resources to promote its premier women’s development programme. Ms Memela previously served as CEO at Eduloan; an organisation focusing on enabling access to the gap market for financial solutions for over 5 years.

Ms Memela is also the non-executive chairman of Memela Pratt and Associates and member of council at the University of Johannesburg.

She previously served in a range of community organisations some of which include; International Partnerships for Micro biocides (IPM) as a director; vice chairperson for the World University Services (Zimbabwe) – a bursary funding organisation for refugees; commissioner at the Strauss Commission - a Presidential Commission of Inquiry into Rural Financial Services; committee member for the Standing Committee for the Revision of the Bank Act; and task team member of the Rural Finance Programmes under the Department of Agriculture.

Ms Memela joined Nedcor in 1993 as Community Liaison Manager and became branch manager in 1994. She was appointed regional manager at People’s Bank (within the Nedcor Group). In 1998 she served as executive director: operations at the Land and Agricultural Bank of South Africa (Landbank), where she also served as managing director (MD) for 18 months. She joined the First Rand Group in September 2001 where she served as an executive in special projects and later as CEO: customer service FNB home loans.

She was MD of the Post Bank from 2006 to 2010. She became CEO of Eduloan in October 2010 where she fulfilled her passion for providing access to education finance solutions, and improving the lives of the urban and rural poor. She holds a BA degree in Social Science from the University of Swaziland and a Master’s degree in Public Administration from the University of Zimbabwe. She has completed a range of executive training programmes at Wits Business School, the University of Johannesburg, the Graduate School of Management and Urban Policy in New York and Wits/Harvard Business Schools.

Hilgard Pieter Meyer

Appointed: 9 June 2011

Qualifications: BCom, FASSA, AMP (Oxford)

Committee responsibilities: chairman of the capital oversight committee; member of the remuneration and nominations committees

Mr Meyer is an actuary with extensive management experience gained over 30 years in a broad range of sectors in the financial services industry including long-term and short-term insurance, pensions, asset management and banking.

Mr Meyer is the managing partner of Nodus Investment Managers, a private equity fund manager he co-founded in 2010. He retired as the Managing Director of the Momentum Group in 2005, a position he held for nine years. Before that, he had exposure to a wide range of actuarial and management positions in the Momentum Group which he joined in 1988. He also worked for Volkskas Pension Services (from 1985 to 1987) and Old Mutual (from 1983 to 1985). His career exposed him to a wide range of technical and management positions, including insurance and investment product development, corporate actuarial, insurance sales and marketing, private banking and trust services, investment banking and fund management.

Mr Meyer is a non-executive director of a number of companies and a fellow of the Actuarial Society of South Africa (FASSA).

Raboijane Moses Kgosana

Appointed: 21 April 2015

Qualifications: BCompt, BCompt (Hons), CA(SA)

Committee responsibilities: Member of the audit committee, the group capital oversight committee and the social, ethics & transformation committee.

Mr Raboijane Moses Kgosana serves as executive chairman of Peduco Properties Investments Proprietary Limited. He has over 34 years of experience in internal and external audit, financial management and administration, as well as business and management consultancy. His extensive industry credentials are based on experience in various industries, including financial institutions, industrial, telecommunications, mining, technology and consumer markets.

Prior to 2015, Mr Kgosana served as the chief executive and senior partner of KPMG Southern Africa. He served as the chairman of the policy board and executive director of consumer markets for KPMG South Africa. Prior to retiring from KPMG in 2015, Mr Kgosana served as the chairman of KPMG Africa and as a member of the KPMG International Board as lead director. He is an independent non-executive director at Famous Brands Ltd and Imperial Holdings Limited and a non-executive director of Massmart Holdings Limited and Transaction Capital Limited.

Mr Kgosana was a founding member of KMMT Chartered Accountants, which merged with KPMG in 2002 and served as a member of KPMG Global Board & Council and KPMG Europe Middle East Africa (EMA) Board.

He was the president of the Association for the Advancement of Black Accountants of Southern Africa, the chairman of the Accounting Practices Board, a member of The Board of the South African Institute of Chartered Accountants and a member of the Standards Advisory Council of the International Accounting Standards Board. He is a Chartered Accountant (SA) by profession.

Executive directors

Matthews Sello Moloko (executive chairman)

Appointed: 3 December 2007

Qualifications: BSc (Hons), PGCE, AMP (Wharton)

Committee responsibilities: Chairman of the social, ethics & transformation committee; member of the remuneration committee.

Mr Moloko is the executive chairman, founder and a shareholder of Thesele Group, a diversified investment holding company.

Mr Moloko began his career in the employee benefits industry in 1989. He later joined the investment management industry as an analyst at Brait Asset Managers and became deputy CEO in April 1997. In 1999 he joined Old Mutual Asset Managers (OMAM) as a senior portfolio manager, and subsequently became executive director in charge of OMAM’s portfolio management and risk management activities in 2001. In 2003, he took over the reigns as CEO of OMAM, a post he left at the end of 2004 to pursue his own business interests. During his tenure at Old Mutual, he served on various boards of the Old Mutual companies both locally and globally.

He serves on the Nelson Mandela Foundation where he chairs the investment committee and serves on several other boards as an independent non-executive director including Stor-Age Property REIT Limited, Sibanye Gold Limited and Gen Re. Mr Moloko has received recognition for his achievements in financial services from the Black Business Executive Circle and Association of Black Securities & Investment Professionals (ABSIP).

Deon Marius Viljoen (group chief financial officer and group chief executive (interim))

Appointed: 3 September 2007

Qualifications: BCom (Hons), CA(SA)

Committee responsibilities: Member of the group capital oversight committee

Mr Viljoen joined the group in March 2003 as finance director of Investment Solutions and was promoted to group chief financial officer in 2007.

He currently serves as an executive director on the main board and on numerous subsidiary boards and committees within the group. Before joining Alexander Forbes, he was a partner and director of PricewaterhouseCoopers Johannesburg in the service line of assurance and business advisory services, having joined a predecessor firm in 1987. Mr Viljoen served on a number of industry bodies including the SAICA banking industry group, chairing SAICA’s investment management and collective investment schemes industry groups for a number of years.

He obtained his BCom accountancy (cum laude) in 1985 from the Rand Afrikaans University (now University of Johannesburg) and completed his BCom honours before qualifying as a chartered accountant (SA) in 1987.

Directorate changes

- Mr E Chr Kieswetter resigned as group chief executive and director with effect from 8 February 2016

- Mr B Petersen resigned as a member of the board with effect from 4 September 2015

- Ms BJ Memela was appointed to the board with effect from 1 July 2015

- Mr RM Kgosana joined the board on 21 April 2015

Company secretary

The company secretary is Ms Janice Eva Salvado (BCom, LLB). She has more than 19 years of experience in the company secretarial field and has served in her role with the group for the past 13 years. At a meeting of the board held on 10 June 2016 at which Ms Salvado recused herself, the board assessed Ms Salvado’s competence, qualifications, experience, suitability and performance during the financial year, as well as her arm’s length relationships. The board concluded that she was suitably qualified to continue to act as group company secretary.

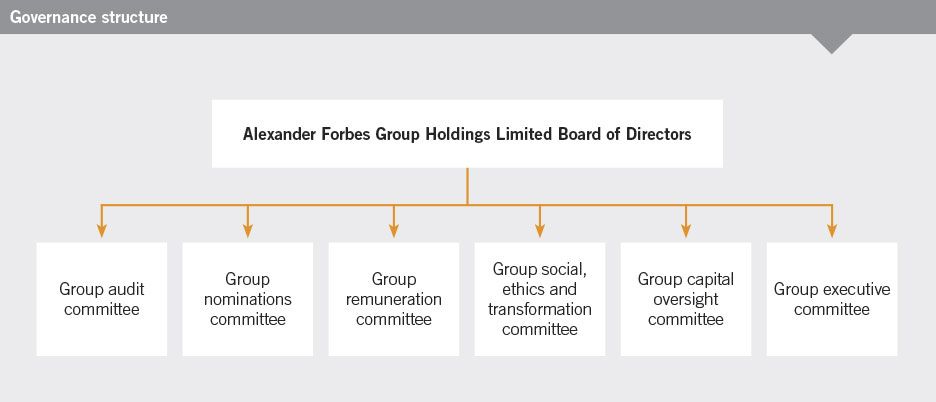

Governance structures

The board committee structure is designed to assist the board of the company in performing its duties and responsibilities. Although the board delegates certain functions to these committees, it retains ultimate responsibility for their activities.

The board has five standing committees:

- Audit committee

- Nominations committee

- Remuneration committee

- Social, ethics and transformation committee

- Group capital oversight committee.

Each board committee has formal written terms of reference that are reviewed every year and, at a minimum, effectively delegate certain of the board’s responsibilities. The full terms of reference for each committee are available on the company’s website.

The committees are empowered to seek outside or other professional advice, as the members consider necessary, to carry out their duties. The board continually assesses the need for additional committees to assist it in carrying out its duties and meeting its statutory and legislative requirements.

Audit committee report

The audit committee is pleased to present its report for the financial year ended 31 March 2016. The audit committee is an independent statutory committee appointed by the shareholders. In compliance with the King III Report and Section 61 of the Companies Act, 2008, the shareholders of the company appointed independent directors as its audit committee in the previous financial year. The board of directors delegates duties to the audit committee. This report includes those duties and responsibilities.

Terms of reference

The audit committee has adopted formal terms of reference, which are reviewed and updated as necessary on an annual basis (or more frequently if required) by both the audit committee and the board. The committee has conducted its affairs in accordance with its terms of reference and has discharged its responsibilities contained therein. A copy of the audit committee’s current terms of reference is available on the company’s website www.alexanderforbes.co.za.

Composition and function

The audit committee comprises three independent members. In accordance with King III, the audit committee members are appointed annually by the shareholders. The Chairman of the board, certain non-executive board members, the group chief executive, the group chief financial officer, the group chief risk officer, the group IT executive, external auditors, internal auditors and other assurance providers attend meetings by invitation. The audit committee undergoes an annual self-assessment.

Roles and responsibilities

The audit committee is satisfied that it complied with its legal, regulatory and other responsibilities during the financial year ended 31 March 2016. The audit committee’s primary objective is to assist the board with its responsibilities for the management of risk, safeguarding of assets, oversight over financial control and reporting internal controls, shareholder reporting and corporate governance, particularly relating to legislative and regulatory compliance. The audit committee’s roles and responsibilities include statutory and regulatory duties as per the Companies Act, 2008 and according to King III on Governance for South Africa 2009. In addition, the board has assigned certain other duties to the audit committee, embodied in its terms of reference. The board reviews these duties and terms of reference on an annual basis.

Meeting attendance

During the year, four meetings were held, attendance at which was as follows:

|

Meeting dates |

||||

|

Committee member |

Jun |

Sep |

Nov |

Mar |

|

D Konar (chairman) |

√ |

√ |

√ |

√ |

|

M Collier |

√ |

√ |

√ |

√ |

|

B Petersen |

√ |

√ |

n/a |

n/a |

|

RM Kgosana |

n/a |

n/a |

√ |

√ |

|

√ – Indicates in attendance. |

||||

The integrated annual report

The audit committee is responsible for overseeing the group’s integrated annual report and the reporting process. The fifth integrated annual report has been reviewed by the audit committee. It focuses not only on the group’s financial performance, but also economic, social and environmental performance. It also sets out how the business has engaged with stakeholders, addressed its material issues and governed its business.

Financial statements and accounting practices

The audit committee has reviewed the annual financial statements for the year ended 31 March 2016, and believes that it presents a balanced view of the group’s performance for the period under review and that it complies with international financial reporting standards.

External auditor appointment and independence

The audit committee has satisfied itself that the external auditor is independent of the group, as set out in section 94(8) of the Companies Act, 2008, which includes consideration of previous appointments of the auditor, the extent of other work the auditor has undertaken for the group and compliance with criteria relating to independence or conflicts of interest as prescribed by the Independent Regulatory Board for Auditors. Requisite assurance was sought and provided by the auditor that internal governance processes within the audit firm support and demonstrate its independence. The committee ensured that the appointment of the auditor complied with the Companies Act, 2008 and any other legislation relating to the appointment of auditors. The committee, in consultation with management, agreed to the engagement letter, terms, audit plan as well as scope of work performed and budgeted audit fees for the 2016/17 year. A formal procedure has been adopted to govern the process whereby the external auditor may be considered for performing non-audit services. The committee has nominated, for election at the annual general meeting, PricewaterhouseCoopers Inc. as the external audit firm and Mr R Hariparsad as the designated auditor responsible for performing the functions of auditor for the 2016/17 year.

The audit committee has satisfied itself that the audit firm and designated auditor are accredited as such on the JSE list of auditors and their advisers.

Internal controls

The audit committee considers significant control deficiencies raised by management and the internal and external auditors and reports its findings to the board. Where weaknesses are identified, the audit committee ensures that management takes appropriate action. Based on assurance obtained throughout the year, the audit committee confirms that the internal controls are working optimally and that there are no known material deficiencies to report on for the past financial year.

Whistle-blowing

During the year, the audit committee reviewed the whistle-blowing programme and reports resulting from the programme. We have ensured that, where appropriate, management made independent investigations and took appropriate follow-up action. The audit committee receives reports of any complaints, whether from within or outside the group, relating to the accounting practices and internal audit of the group, the content or auditing of the group’s financial statements, the internal financial controls of the group and related matters.

Combined assurance

The audit committee is satisfied that the group has optimised the assurance coverage obtained from management, internal and external assurance providers, in accordance with an appropriate combined assurance model.

Going concern

The audit committee has reviewed a documented assessment, including key assumptions prepared by management, of the going concern status of the group and has made a recommendation to the board in accordance therewith. The board’s statement on the going concern status of the group, as supported by the audit committee, appears in the directors’ responsibility for financial reporting section of the integrated annual report.

Governance of risk

The audit committee fulfils a dual function, being both an audit committee and a risk committee. Internal audit performs a full assessment of the risk management in a function and framework on an ongoing basis.

Internal audit

The audit committee is responsible for ensuring that the group’s internal audit function is independent and has the necessary resources, standing and authority within the group to enable it to perform its duties. Furthermore, the audit committee oversees cooperation between the internal and external auditors, and serves as a link between the board of directors and these functions. The audit committee approved the internal audit charter and the internal audit function’s annual audit plan during the year under review.

The internal audit function reports to the relevant divisional audit committees with responsibility for reviewing and providing assurance on the adequacy of the internal control environment across all of the group’s operations. The head of group internal audit is responsible for regularly reporting the findings of the internal audit work against the agreed internal audit plan to the audit committee. The head of group internal audit has direct access to the group audit committee, primarily through its chairman. During the year, the committee met with the external auditors and with the head of group internal audit without management being present.

Evaluation of the expertise and experience of the group chief financial officer (GCFO) and the finance function

The audit committee has satisfied itself that the GCFO has appropriate expertise and experience to execute his designated functions. The audit committee has considered and has satisfied itself of the appropriateness of the expertise, experience and adequacy of resources of the finance function.

Internal financial controls

Based on the review of the design, implementation and effectiveness of the Group's system of internal financial controls conducted by the Internal Audit Function during the year under review, and reports made by the independent external auditors on the results of their audit and management reports, the Committee is satisfied that the Company’s system of internal financial controls is effective and forms a basis for the preparation of reliable financial statements. No findings have come to the attention of the Committee to indicate that any material breakdown in internal controls has occurred during the past financial year.

Consolidated and separate annual financial statements

Having reviewed the audited consolidated and separate Annual Financial Statements of the Group, particularly to ensure that disclosure was adequate and that fair presentation had been achieved, the Committee recommended the approval of the consolidated and separate Annual Financial Statements to the Board.

Subsequent events

There have been no material changes in the affairs or financial position of the Company and its subsidiaries since 31 March 2016.

Matters for consideration at annual general meeting

Election of committee members

The Audit Committee is a statutory committee elected by the shareholders and in terms of section 94(2) of the Companies Act, read with Chapter 3 of King III, the shareholders of a public company must elect the members of an Audit Committee at each Annual General Meeting. In terms of Regulation 42 the Companies Regulations, at least one-third of the members of the Company’s Audit Committee at any particular time must have academic qualifications, or experience in economics, law, corporate governance, finance, accounting, commerce, industry, public affairs or human resource management.

Appointment of independent external auditors

In terms of section 90(1) read with section 61(8) of the Companies Act (which requires that shareholders approve the appointment of the independent external auditors on an annual basis) the committee will in due course, prior to the next annual general meeting, consider and make recommendations to the board, which in turn will make recommendations to the shareholder(s) relative to the appointment of the company’s independent registered auditors for the year ending 31 March 2017.

Dr D Konar

Chairman of the Audit Committee

8 June 2016

Nominations committee

The nominations committee is chaired by the board’s lead independent director, Mr M Collier, with additional members comprising Mr H Meyer (independent director), Ms BJ Memela (independent director) and Mr WS O’Regan (non-executive director). Ms Memela and Mr O’Regan were appointed as members of the committee with effect from 1 July 2015 and Mr Moloko resigned from the committee on 8 February 2016.

During the year under review, the committee held four meetings as scheduled. Meeting attendance averaged 82%. Meeting attendance is reflected in the table below:

|

Committee member |

Meeting dates |

|||

|

3 Jun |

3 Sep |

25 Nov |

9 Mar |

|

|

M Collier (chairman) |

√ |

√ |

√ |

√ |

|

MS Moloko |

√ |

√ |

√ |

n/a |

|

H Meyer |

X |

√ |

√ |

√ |

|

BJ Memela |

n/a |

√ |

X |

X |

|

WS O’Regan |

n/a |

√ |

√ |

√ |

|

√ – Indicates in attendance. |

||||

Key focus areas in 2016

During the year under review, the committee considered the following matters in accordance with its work plan and terms of reference:

- Oversaw the identification and procedure for the appointment of suitable directors to the board, taking into consideration fit and proper procedures and the requirements of the board and committee’s terms of reference.

- Reviewed succession management.

- Approved a policy on the procedure for the appointment of directors.

- Reviewed and approved updated terms of reference.

- Assessed the independence of the group company secretary.

- Performed a self-assessment of the committee’s performance.

- Considered the directors retiring by rotation at the 30 July 2015 AGM, in terms of their skills, expertise and contribution and agreed that the Chairman report to the board that a recommendation be made to shareholders that the directors be re-elected.

- Recommended appointment of independent directors to board committees.

Remuneration committee

The remuneration committee is chaired by the board’s lead independent director, Mr M Collier, with additional members being Mr H Meyer (independent director), Ms BJ Memela (independent director), Mr WS O’Regan (non-executive director) and Mr MS Moloko (executive director and chairman of the board). Ms Memela and Mr O’Regan were appointed as members of the Remuneration Committee with effect from 1 July 2015.

During the year under review the remuneration committee held six meetings, with average attendance of 81%. Meeting attendance is reflected in the table below:

|

Meeting dates |

||||||

|

Committee member |

20 May |

3 Jun |

30 Jul |

3 Sep |

25 Nov |

9 Mar |

|

M Collier (chairman) |

√ |

√ |

√ |

√ |

√ |

√ |

|

MS Moloko |

√ |

√ |

√ |

√ |

√ |

√ |

|

H Meyer |

X |

X |

√ |

√ |

√ |

√ |

|

BJ Memela |

n/a |

n/a |

√ |

√ |

X |

X |

|

WS O’Regan |

n/a |

n/a |

X |

√ |

√ |

√ |

|

** Special meeting. |

||||||

Key focus areas in 2016

During the year under review, the remuneration committee held two special meetings in addition to its four scheduled meetings and oversaw the following aspects of its workplan:

- Considered the independent director fee increase for recommendation to shareholders at the company’s annual general meeting, and approved independent directors’ fee allocations within the approved fee structure.

- Reviewed the group’s remuneration practices and philosophy, reviewed and adopted a revised group remuneration policy and strategy.

- Oversaw the adoption and rollout of a revised employee grading model.

- Approved revised long-term incentive plan (LTIP) rules for referral to shareholders for approval in the listed environment.

- Approved the bonus pools available for allocation.

- Researched and reviewed the mix of fixed and variable pay per category of employee so as to ensure that this was aligned with the group’s needs and strategic objectives.

- Considered and agreed the overall payroll increase to be applied for the year.

- Performed its annual self-assessment and received and considered the report in this regard.

- Discussed and reviewed the group executives’ performance scorecards and approved their increases and bonuses for the year ended 31 March 2015.

- Considered and approved the performance conditions and measures for the LTIP.

- Approved the allocation framework for the second tranche allocations for the LTIP.

- Confirmed the methodology applied to the allocation of proceeds to the participants in the Isilulu Trust.

- Performed the annual review of its terms of reference and annual work plan and approved same.

- Approved the group scorecard and the group chief executive’s performance contract.

- Approved the 2016 bonus funding model.

Social, Ethics and Transformation

Committee report

In accordance with the Companies Act and the Companies Regulations, the board took a decision on 24 November 2011 to incorporate a social and ethics committee (the committee) into its existing transformation committee to form a newly constituted Social, Ethics and Transformation Committee.

The committee is currently chaired by the chairman of the board, Mr MS Moloko, with additional membership comprising Mr DJ Anderson (non-executive director), Mr RM Kgosana (independent director) and Ms BJ Memela (independent director). Ms Memela and Mr Kgosana were appointed as members of the committee with effect from 1 July 2015.

The group chief executive, group chief financial officer, group human resources officer, group chief risk officer, group transformation manager, and the business unit leaders are permanent invitees to committee meetings.

During the year under review the committee held four meetings, with meeting attendance averaging 82%. Meeting attendance is reflected in the table below:

|

Meeting dates |

||||

|

Committee member |

2 Jun |

2 Sep |

25 Nov |

9 Mar |

|

MS Moloko (chairman) |

√ |

√ |

√ |

√ |

|

D Anderson |

√ |

√ |

√ |

√ |

|

E Chr Kieswetter |

√ |

√ |

√ |

n/a |

|

BJ Memela |

n/a |

√ |

X |

X |

|

RM Kgosana |

n/a |

√ |

√ |

√ |

|

√ – Indicates in attendance. |

||||

The committee operates under formal terms of reference which requires it to meet at least twice a year to fulfil:

- the functions assigned to it under the Companies Regulations; and

- other functions that the board assigns it, including the fulfilment of the key objectives of transformation and strategies aligned therewith, as well as overseeing and monitoring activities in relation to social and economic development, good corporate citizenship, corporate social responsibility, ethical behaviour and managing environmental impact; consumer relations and labour and employment development.

The committee receives reports from other committees and in turn reports on relevant matters within its mandate to the board. One of its members must report on the committee’s functions to shareholders at the company’s annual general meeting.

This report, which describes how the committee has discharged its responsibilities in respect of the financial year ended 31 March 2016, will be presented to shareholders at the annual general meeting to be held on 26 August 2016.

Responsibilities

The objectives and responsibilities of the committee, which are aligned with the committee’s statutory functions as set out in the Companies Act and Companies Regulations, form the basis of the annual work plan that the committee has adopted. The specific activities that the committee is required to monitor, with reference in particular to adherence to relevant legislation, regulation and codes of best practice, include:

- Social and economic development, including the group’s standing relative to the 10 Principles of the UN Global Compact, the Organisation for Economic Cooperation and Development (OECD) recommendations regarding the combating of corruption, and South Africa’s Employment Equity Act and Broad-Based Black Economic Empowerment Act;

- Good corporate citizenship, including the group’s positioning and efforts in promoting equality, preventing unfair discrimination and combating corruption, the group’s contribution to the development of communities in which it operates and the group’s record of sponsorships, donations and charitable giving;

- The environment, health and public safety, including the impacts of the group’s activities on the environment and society;

- Consumer relationships, including the group’s advertising, public relations and compliance with consumer protection laws;

- Labour and employment, including the group’s standing relative to the International Labour Organisation (ILO) protocol on decent work and working conditions, and the group’s employment relationships and contribution to the educational development of its employees; and

- Generally, the monitoring of the social, ethics, economic, governance, employment and environmental activities of the group.

The objectives that support Alexander Forbes’ sustainability policy include the promotion of environmental health and public safety and good corporate citizenship, including the promotion of equality, the prevention of unfair discrimination and the reduction of corruption.

Key focus areas for 2016

During the year under review, the committee oversaw the following aspects of its work plan (at business unit and group levels):

Ethics

The group’s commitment to the highest ethical standards is set out in the code of ethics and ethics policy. Alexander Forbes is a member of the Ethics Institute of South Africa and an ethics hotline is operated by independent service providers.

The committee reviewed the group’s Code of Ethics. Refresher training for all employees and inclusion in the induction programme was agreed.

A member of the group executive is responsible for the implementation and success of a wide-ranging ethics programme.

The whistle-blower line received seven allegations which were all investigated. In respect of all allegations, appropriate action was taken following proper review. There were no reported instances of discrimination reported in the year.

Labour

Our employment equity strategies and policies enshrine our commitment to the implementation of employment equity across the group. Our various Transformation structures, including employment equity forums, continue to provide input into the implementation and management of employment equity initiatives in the group. During the year under review, particular attention was given to the revised Broad-Based Black Economic Empowerment Codes of Good Practice and related developments in the Financial Sector Charter. Reports on the business’ B-BBEE verification by an independent rating agency were received and transformation progress reports were reviewed.

Skills Development remains an area of focus and various programmes have been implemented.

Health and safety

The group continues with its endeavours to improve its health and safety practices and regular reports are reviewed by the committee on the status of occupational health and safety. Particular focus has been given to the safe evacuation of employee in crisis situations. There was ongoing training and awareness-raising of employees around health and safety requirements; and our crisis management plan and evacuation procedures were reviewed.

Socio-economic development

In line with our strategic intent to be welcomed in the communities in which we operate, Alexander Forbes strives to support the advancement of all communities, with emphasis on previously disadvantaged communities, where its operations are located. Our corporate social investment policy entrenches this philosophy. Sustainable community development is achieved, among others, through investing in community-related projects, employment, procurement and supply chain development.

Sustainability

The committee reviewed the environmental impact of the group’s offices and its practices during the year under review. A financial services group’s direct environmental impact is limited. However, the group focuses on minimising its footprint and paying attention to its financial sustainability. These matters are elaborated upon on throughout our integrated report.

Additional matters

The committee received regular updates on anti-money laundering monitoring initiatives, Occupational health and safety initiatives, the group-wide treating customers fairly project implementation. Confirmation was received that a strategy had been adopted for economic crime prevention.

Donations and sponsorships continue to be monitored by the committee as part of its mandate. The responsible investing initiative led by Investment Solutions was brought to the committee and reflected pleasing progress in communicating the message that the group has formulated four years ago.

The committee monitored the group and business unit social, ethics and transformation reports and reviewed the results of the annual employee employment equity survey. The pillars of transformation were given considerable discussion time at each meeting of the committee.

Conclusion

The committee has fulfilled its mandate in terms of the Companies Act and terms of reference over the past financial year.

MS Moloko

Chairman

9 June 2016

Group capital oversight committee

The group capital oversight committee is chaired by an independent chairman, Mr H Meyer, with additional members being Messrs RM Kgosana (independent director) and DM Viljoen (interim group chief executive and group chief financial officer).

The objective of the committee is to monitor and direct the capital and capital adequacy risk profile of the group.

During the year under review the committee held four meetings, with attendance averaging 94%. Meeting attendance reflected in the table below:

|

Meeting dates |

||||

|

Committee member |

8 May |

2 Sep |

25 Nov |

4 Mar |

|

H Meyer (Chairman) |

√ |

√ |

√ |

√ |

|

D Anderson |

√ |

X |

√ |

√ |

|

E Chr Kieswetter |

√ |

√ |

√ |

n/a |

|

DM Viljoen |

√ |

√ |

√ |

√ |

|

RM Kgosana |

n/a |

√ |

√ |

√ |

|

√ – Indicates in attendance. |

||||

Key focus areas for 2016

During the year under review, the committee made the following progress in terms of its work plan:

- Approved terms of reference and an annual work plan.

- Reviewed solvency and liquidity assessments for the group and identified subsidiaries.

- Considered dividend recommendations in terms of solvency and financial soundness.

- Oversaw capital adequacy of insured entities.

- Considered the group’s capital structure and balance sheet management.

- Received own risk solvency assessment (ORSA) and consolidated supervision reports, staying abreast of FSB developments in this regard.

- Received updates on stress and scenario testing.

- Received feedback from the SAM steering committee.

Executive committee

In 2016, the group executive committee met on a quarterly basis with a primary focus on reviewing the state of the business. Reports are received from the group chief executive and group chief financial officer at each meeting, as well as from each of the cluster heads. Should any other matter of group wide importance require discussion, it may be added to the agenda by a member of the committee.

The committee comprises:

Deon Viljoen (group chief executive (interim) and group chief financial officer)

Tenure with the company: 1 March 2003

Gari Dhombo (managing director, AFI)

Tenure with the company: 1 November 2002

Peter Edwards (managing director, financial services institutional)

Tenure with the company: 1 February 1996

Brad Eliot (group executive, information technology)

Tenure with the company: 1 September 1998

Thabo Mashaba (group chief human resources officer)

Tenure with the company: 1 April 2012

Derrick Msibi (managing director, Investment Solutions)

Tenure with the company: 1 January 2009

Vishnu Naicker (group chief risk officer)

Tenure with the company: 1 April 2008

Luendran Pillay (managing director, AfriNet)

Tenure with the company: 1 May 2012

Steve Price (group executive: operations, technology and systems)

Tenure with the company: 13 July 1999

Sugendhree Reddy (managing director, retail)

Tenure with the company: 1 August 2015

Janice Salvado (group company secretary)

Tenure with the company: 1 April 1999

Lynn Stevens (group executive: brand, marketing & communications)

Tenure with the company: 1 August 2010

Grant Stobart (managing director, AF International)

Tenure with the company: 15 December 2003

Changes in membership

- Mr S Price joined the committee in his capacity as group executive: operations, technology and systems on 1 May 2015.

- Ms S Reddy joined as managing director of Retail Holdings on 1 August 2015.

- Mr E Chr Kieswetter resigned as group chief executive on 8 February 2016.

- Mr D Viljoen, the group chief financial officer, has with effect from 8 February 2016, added the role of interim group chief executive to his portfolio.

King III governance

Alexander Forbes aims to follow the King III principles as closely as possible and the table of how each principle is applied is available on our website. Our application of the following principles differs from the guidelines as follows:

|

King III principle |

Explanation |

|

|

Principle 2.25 |

Non-executive directors’ fees do not comprise both a base fee and an attendance fee per meeting. |

This has been considered and rejected by the remuneration committee. |

Governing IT

Alexander Forbes’ IT governance strategy ensures that risk management is operationally entrenched and included in the performance scorecards of IT managers and senior employees.

IT is represented at a board level by the group IT director, who is a member of the group exco as well as the audit and risk committees. Furthermore, senior IT executives are included in working groups tasked with embedding regulatory requirements – such as POPI, SAM and TCF – throughout the organisation.

Our IT governance framework is based on a combination of local and international frameworks, including:

- King III

- Information Technology Infrastructure Library (ITIL v3)

- Control objectives for information and related technology (COBIT)

This ensures local relevance as well as alignment with best practice. The framework is supported by a series of policies and procedures that enable the group to ensure compliance with our framework’s demanding standards. In 2016, Alexander Forbes continued its transition to COBIT 5, the latest iteration of the framework released by ISACA, an international IT governance association. This involved mapping our internal processes and addressing identified gaps in terms of the new framework. This approach has been approved by the audit committee and board.

Management monitors compliance with the IT governance framework on an ongoing basis. Disaster recovery and business continuity systems and procedures all conform to the highest international standards and protocols and are regularly tested. No material control or governance deficiencies were identified during the year under review.

On a functional level, the various IT steering committees oversee the implementation of the IT governance framework, its work also includes monitoring and reporting on IT performance and service and project delivery. The group IT director reports to the board (which is ultimately responsible for IT governance) through the audit committee on such projects including proposals for significant IT expenditure. The CIO also reports, on a formalised quarterly basis, to the audit committee on the top-10 IT risks.