The basics of asset allocation within a portfolio

Asset allocation within an investment portfolio is the decision of how to spread funds among a variety of broad asset classes and to take full advantage of the potential return for a given level of risk.

Below is an explanation of the different asset classes that may be included in your portfolio. It is advisable to work with an accredited financial planner when determining which asset class to consider:

| Type of investment or asset class | Volatility and investment returns | |

|---|---|---|

| Cash |

With a cash investment, you put your money in a bank and the bank pays you a return. The return is in the form of interest, which is based on the value of the sum of money you deposited. You invest in cash when you need a secure return, and when you can’t run the risk of the value of your investment decreasing over the short term. |

Cash is generally considered the safest asset class for investment, because the value of your investment will not drop. However, long-term investment returns on cash are usually lower than the other asset classes. Over the long term, an investment in cash does not generally outperform inflation. |

| Fixed interest/bonds |

With bonds you lend money to the government, a parastatal or a large company that agrees to pay you interest on the amounts loaned, but also agrees to give your capital (the initial investment) back at the end of a pre-determined period. Bonds are less risky than shares, but more risky than cash, although they also generally give better returns than cash over a longer period. |

Bond values can change quite quickly because the value depends on interest rates. The value of the investment depends on current interest rates, with bond values tending to go up as interest rates drop, and dropping when interest rates go up. Bonds do experience volatility but are usually less volatile than shares. |

| Shares |

With shares (also known as equities), you buy a share or part of a company that is listed on the Johannesburg Stock Exchange (JSE). As a shareholder, you may share in the profits of the company (dividends), which are your portion of the profit that the company makes. The value of a company’s share can be seen by reading the prices quoted on the JSE. These are the prices at which the shares were bought and sold, and are determined by the amount people are prepared to pay or receive, to either buy or sell their shares on the open market. |

The values of shares can change often and quickly compared to other asset classes and are seen as very volatile in the short term. Historically, shares have given the best investment returns over the longer term. |

| Property |

Investing in property generally means investing in industrial, retail or commercial property, either as a direct ownership or else through a listed property company. You get returns on your money through rent paid, as well as through changes in the underlying value of the property (ie a capital gain or loss). |

Investing in property as an asset class is not the same as investing in property as an individual owner of one or more privately owned properties. In general, this asset class is suited to the investor with a longer-term investment horizon (at least five years), who expects to achieve a relatively stable return from year to year. |

| Alternative investments |

These usually form a very small part of the asset class ‘basket’. They represent investments such as those in infrastructure (for example roads and airports), private equity investments (investing directly in a particular company) and hedge funds (reducing risk by implementing strategies that are often not dependent on the direction of the market). |

Returns come from income on infrastructure investments and profits or losses made by the company invested in. The risk and return associated with an alternative investment depends on the actual investment itself. |

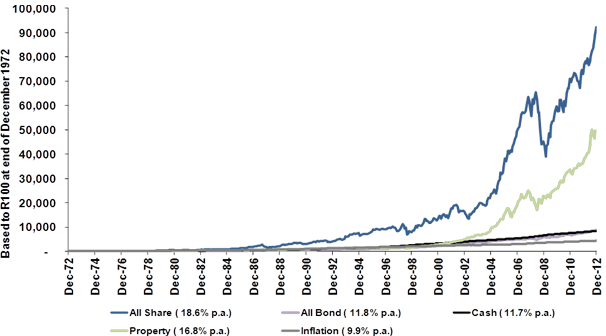

The graph below shows returns of the different asset classes over a 40-year period before tax (Dec 1972 to Dec 2012). Please note that past performance is not indicative of future returns.